First Time Home Buyers Guide

More stressed out about buying a home than getting married?

So are most Canadians and there was even a survey done about it here.

That is shocking when you consider there are no in-laws involved.

In all seriousness, being a first time home buyer does involve a lot of unknowns which can be stressful. It’s a big financial and emotional decision so it’s only natural to be stressed.

In this short guide, we will run through some of the most important things to think about as a first time home buyer. For the past 4 decades we’ve helped guide thousands of first time home buyers just like you.

It’s the most rewarding part of our work to assist and educate first time home buyers. Leading them from timid and cautious to confident home buyers and mortgage shoppers. Let's get started!

The 3 Pillars for first time home buyer success

Even though there are lots of subtle technical details when shopping for your first home and mortgage, they can all be summarized into 3 simple pillars.

- Savings

- Income

- Preparation

1 - SAVINGS: How much do I need to save to buy my first home?

This is probably the biggest question weighing on your mind. As you can imagine, if you want to participate in real estate you’ve gotta have your own skin in the game.

You are probably the most familiar with the term ’down payment’ when it comes to talking about the costs you’ll face while buying a home. While it is one of the larger items, there are some other significant costs associated with making a home purchase beyond just the down payment.

Costs to budget for when buying your first home include:

- Down payment

- Land transfer tax

- Legal fees & closing costs

- Miscellaneous costs

Making sure you budget for the other costs will save you a lot of headaches and frustration while going through the home buying journey because you will have a clear picture of what exactly you can afford. Plus, no one really likes unexpected costs, or to get the bill for something they forgot about! After doing this for over 40 years, we’ve seen this happen to so many homebuyers and would love to save you the same ‘ugh’ moment many others have had.

Expenses are the least fun topic, but let’s face them head on and get this part over with.

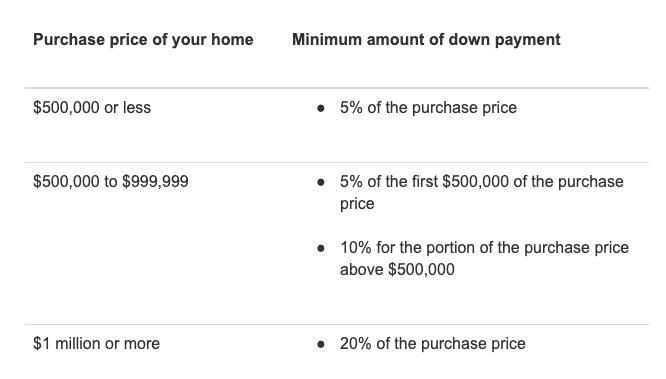

Down payment

The minimum down payment required to purchase a home in Canada changes depending on various factors.

2. INCOME: How much can I qualify for?

Now that you’ve got all that cash saved up burning a hole in your pocket you’re ready to consider the next step… figuring out how much you can qualify for from a mortgage lender.

For this part it’s important to remember the difference between what you qualify for vs what you can comfortably afford.

There is a difference and just because a mortgage lender will allow you to borrow $X doesn’t mean it is the right decision for you. You have to carefully consider your lifestyle and other obligations.

Watch: VIDEO MESSAGE - the difference between qualifying and affording.

How mortgage lenders qualify you for a maximum mortgage

Real Quick: A Maximum Mortgage is the most amount of money you can get for your mortgage. Or the ‘max’ amount.

The maximum mortgage amount you qualify for is determined by your monthly gross income vs your monthly debts obligations. Pretty much the ratio between your income vs expenses.

In the mortgage business we call them debt to service ratios.

To figure out debt service ratios we have to do math. I’ll spare you the details but for any keeners you can visit the following resource (Blog post: What is total debt servicing ratio)

As a general rule of thumb mortgage lenders want to see that you are not carrying more than 42% of your gross monthly income in monthly payments.

For example: A household with $10,000 of monthly income shouldn’t be carrying more than $4,200 in monthly debts including mortgage payments, property taxes, condo fees, heat & other consumer debts.

Some factors such as your down payment amount, credit score, property type will affect the debt servicing requirements. Some lenders are more flexible and relaxed while others are tighter and restrictive.

If you're looking to see what you can qualify for, you can start the application process by downloading the exclusive Home Center App here.

3 - PREPARATION: What do I need in order to make a successful offer on my first home purchase & mortgage application?

The devil is in the details.

You’ve got your budget sorted for your closing costs and down payment.

You’ve got good steady income flowing into your bank account.

Now it’s time to put it all together.

Before you start searching for the perfect home with a realtor you need to be pre-approved for your mortgage.

A pre-approval is useful for a number of reasons.

Number one,it gives you confidence. The exercise of getting pre-approved allows us to review the details of your application. This includes checking your credit history and flagging any potential pitfalls. This way, you have all the information you need from the beginning of the process and it will make everything go much more smoothly!

With a pre-approval in hand you can move forward with an offer knowing that the financing will be there for you.

Number two - and this one is pretty cool - it helps to protect you from rising rates and changes to qualification requirements.

A pre-approval is valid for 120 days. It’s useful to protect you from rising interest rates during that 120 day period because the rate gets locked-in. So if rates go up during that 120 day period you are protected and the rate you were offered in your pre-approval will be honored. Of course if rates improve during that period you benefit but at least it’s an insurance against future increases.

Ready to get started?

Ready to get the process started?

As a first time home buyer, getting the mortgage application process started sooner is always better than later. Click below to book a call to talk about your goals and get a plan in place to help you purchase your first home this summer!

Get in Touch

When you are looking for expert mortgage advice when buying your first home, we are here to help. We will guide you through the process and help you plan for your financial future.

Get in touch with us today to schedule a pre-qualification and get started on your journey towards becoming a first time home buyer!