The definitive 2023 guide to private mortgage financing

This guide is meant to demystify and answer some basic questions about private equity financing in order to help you decide if a private mortgage is right for you.

Chapter 1

The difference between a private mortgage and institutional bank mortgage

Video not working? Watch here on YouTube.

First, let's define what a private mortgage is, and what makes it so different from a mortgage that you might get from your bank or through a mortgage broker.

At its core, the answer has to do with how each type of lender approaches the 5 Cs of credit:

- Capacity = Income

- Credit = Credit history and outstanding debt obligations

- Capital = Down payment or existing equity in a home

- Collateral = The underlying real estate asset and its value

- Character = Other life circumstances that have affected the credit application

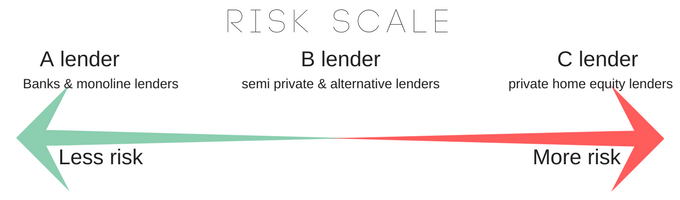

Your institutional lenders are looking for the crème de la crème in each of the 5 Cs with very little leniency or flexibility if a borrower doesn’t fit into their narrow categories. This strict lending criteria can marginalize borrowers and lead them to have to deal with pricier home equity loans and private mortgages.

Note that in 2018, with the introduction of stricter bank regulation policy by the Office of the Superintendent of Financial Institutions (OFSI), meeting the criteria of your bank got that much harder. Regulators have argued that it is in the best interests of Canadians to have stricter mortgage qualification rules.

However, what we are seeing is that it is hurting some borrowers.

Borrowers who represent low borrowing risk, but don’t meet the exigent criteria for A lenders, need to pursue more expensive mortgage financing from private lenders.

Private home equity mortgage lenders to the rescue

Private mortgage lenders consist of individuals like you and me, or groups of individuals who have pooled money together to lend. Unlike banks, credit unions, finance institutions, etc., private lenders have more discretion and flexibility on their lending guidelines.

From a private home equity mortgage lender’s point of view, a private mortgage is an investment opportunity secured on your real estate.

However, to believe that private home equity mortgage lenders will throw money at you just because you own a house is completely wrong.

Like banks and institutional mortgage lenders, a private lender will still consider the 5 Cs of credit. However, they will be more willing to make exceptions and pursue the opportunity to earn a higher interest rate on their mortgage loan.

Chapter 2

The four most common reasons a borrower needs a private mortgage

Video not working? Watch here on YouTube.

Mark Twain once wrote: “A banker is a fellow who lends you his umbrella when the sun is shining, but wants it back the minute it begins to rain.”

Unless you’ve been in a difficult financial situation, you can’t appreciate just how right Mr. Twain is. Trying to talk to your banker or mortgage broker when life throws you a curve ball can be frustrating and outright demeaning.

The 4 most common reasons why a borrower might need a private mortgage

#1 Debt consolidation & credit rehabilitation

There is no shortage of reasons why you might have taken on more debt than you can manage.

Health issues, relationship stress, business failure, consumerism, and bad financial advice are all reasons why you might have stretched your credit cards and lines of credit to the limit.

If you’re lucky, you’ll be able to consolidate the debt into your existing first mortgage through your bank or “A” lender.

However, if you don’t meet the minimum lending requirements and have missed payments on your debt, you can find yourself in trouble.

Debt has an amazing ability to snowball, especially if you can’t get help from your bank/institutional mortgage lender. Without an option to consolidate, you’ll find yourself with growing debt loads, which affect your credit score.

This is where a private second (2nd) mortgage lender or private home equity lender comes in handy.

Most private home equity lenders will go up to 75-80 per cent of the market value as determined by an appraisal. This is a rule of thumb and depends on need, location, and exit strategy.

With the money made available by the private home equity mortgage lender, you’re able to consolidate your debt at a lower interest rate into one payment that is hopefully more manageable.

The purpose of the loan isn’t just to improve cash flow. There needs to be a very clearly defined exit strategy.

In the case of debt consolidation, the exit strategy is to pay debts off to improve overall credit score over a 12 month period. With new and improved credit, you should be able to approach your first mortgage lender to consolidate into a first mortgage, so that life can go on.

The biggest risk of using a private home equity mortgage or second mortgage for debt consolidation is if your score doesn’t improve, or you can’t consolidate with your first. In that case, you’ll be stuck perpetually with a high interest mortgage that can be detrimental to your financial well-being.

If you proceed with a private second or home equity mortgage to consolidate debt, you’ll want to make sure that you qualify for the eventual “take-out” mortgage required at the end to consolidate both your mortgages together.

#2 Property or income tax arrears

Tax arrears can be a real issue for homeowners. The smallest arrears can present a major hurdle for most "A" or institutional mortgage lenders.

Income tax arrears and/or property tax arrears cannot be financed by most institutional mortgage lenders. It’s generally considered an extremely important indicator of creditworthiness if a borrower has any kind of tax arrears. Your obligation to pay income tax and property tax is the most fundamental responsibility of a borrower.

There is an added risk to the lender if there are tax arrears, because Canada Revenue Agency and your local municipality can take legal action to sell a house to recover their arrears. In this case, the arrears actually take first position from the mortgage lender, diminishing their security position.

A private home equity or second mortgage can provide the liquidity you need to pay your arrears.

After funding the private mortgage, you’ll have the ability to pay your arrears. With proof in hand that you’ve made payments, you can then return to your first mortgage lender to refinance.

Ironically, a first mortgage lender can’t refinance to pay off tax arrears. However, they can refinance to pay off a private home equity or second mortgage. So it’s kind of a two-step dance that needs to be done to present your application for the final approval with your "A" lender so that you can move forward with more conventional financing.

#3 Stop power of sale

To be under power of sale means that homeowners have broken the covenant of their mortgage lender(s) and legal proceeding have commenced to recover money owed to the lender via a court ordered sale of the property.

This is a terrible and sad situation, typically accompanied with a story of struggle. We’ve observed that homeowners generally want to do right by their obligation.

A private home equity loan or second mortgage can help to stop a power of sale and give dignity to the homeowner to sell on their own terms and timeline.

The financing provided can be used to pay any arrears and legal costs to bring the first mortgage into good standing, and also provide extra cash flow for living expenses and/or home improvements until the property is listed and sold.

The benefit for a homeowner to employ a private home equity or second mortgage is that it allows them to protect the equity they’ve built up in their home. If sold under power of sale, a mortgage lender can add any number of sundry charges for legal and admin work, eating up huge chunks of equity.

#4 Bridge loan / financing

The need for a bridge loan comes from timing issues. The need for bridge financing typically arises out of the need for funds outpacing availability of funds. The most common example is when a home is purchased prior to a home being sold. In this case, money for a down payment is tied up until a home is sold.

Banks and institutional lenders all provide bridge financing, but there is one critical condition. There has to be a firm sale on the property you’re selling. That can be a little tricky at times if the market doesn’t co-operate, or if personal circumstances prevent the sale.

A private home equity loan is the perfect solution if you find yourself in this situation.

The private lender can typically provide a loan collateralized against both of your properties to provide the required liquidity.

In addition to real estate closings, bridge loans may arise out of business needs, or the need to pay family, prior to you being liquid with cash.

The key feature of a bridge loan is that as a borrower, your exit strategy is cash that will be made available on a short term basis.

Chapter 3

The difference between a second mortgage, line of credit, and home equity loan

Video not working? Watch here on YouTube.

This chapter is all about clarifying some nomenclature about mortgage financing. You might be a little confused about what types of mortgage financing are available, what each one is called, and how they differ.

Second (2nd) mortgages, home equity loans, and lines of credit all can loosely be used to describe the same thing. However, each one of them definitely refers to something specific.

What is a home equity loan?

Simply put, a home equity loan is any loan/mortgage that has been secured against real estate. Secured means that interest in the property has been registered on title via a mortgage or collateral charge.

Types of home equity loans can include:

- First mortgage

- Second mortgage

- Third mortgage

- Line of credit

- Collateral mortgage

While the term is very broad, in the Canadian mortgage origination industry, home equity loans refer to something more specific.

A home equity loan typically refers to a type of mortgage where more importance is placed on the equity available in a borrower’s home rather than the personal covenant or creditworthiness of a borrower.

Borrowers who have difficulty showing strong income or have blemishes on their credit reports can rely on private home equity lenders if they have sufficient equity in their home.

Since banks and institutional lenders have stricter borrower guidelines, home equity mortgages tend to be the domain of private mortgage lenders. There are a number of reasons why a borrower requires a private home equity loan/mortgage.

What is a second mortgage?

Mortgages are ranked (1st, 2nd, 3rd etc.. ) according to the timing of registration.

For example…

Home purchased September 1st 2012 for $500,000.

First mortgage secured on September 1st 2012 for $250,000.

Second mortgage secured on June 1st 2014 for $25,000.

If the first mortgage were paid out in full and discharged, the second mortgage would move up into first position.

Mortgage lenders can provide postponements to allow positions to be changed or permit new lenders to take a lower position.

The ranking of a mortgage determines how secure a mortgage loan is because upon sale of a property, the first mortgage lender gets paid out prior to the second or third mortgage lender. This is especially important under power of sale because additional charges can be added to each mortgage, diminishing the equity/security position of higher positioned mortgages.

For this reason, very few banks or institutional lenders will finance second mortgages. It is a highly specialized area of lending, typically dominated by private home equity lenders.

What is a secured line of credit?

A secured line of credit is a special kind of credit charge on title which allows credit to be re-advanced or revolving. Unlike a mortgage, which has specific repayment terms as determined by its amortization, the line of credit can be advanced and paid back with complete flexibility.

Lines of credit are definitely a type of home equity loan. In fact, they are often called HELOCs or Home Equity Lines of Credit.

Lines of credit can also be a type of second mortgage.

Why?

Because a line of credit might be in second position behind an existing first mortgage.

Lines of credit are limited to a maximum amount of 65 per cent of your home’s value. If your line of credit is in second position, it cannot exceed 80 per cent loan to value of your home’s value.

For example...

$1,000,000 valued home.

$650,000 would be the maximum size of the line of credit. However, if there were an existing first mortgage of $500,000, then the maximum line of credit would be scaled back to $300,000 due to the 80 per cent LTV limitation.

Banks and "A" lenders tend to be very strict when it comes to underwriting secured lines of credit, and in general they will only take a second position if they are the lenders who hold the first mortgage as well.

Secured lines of credit are reserved for highly creditworthy borrowers and are rarely, if ever, offered by private home equity lenders.

In general, if you are a creditworthy borrower with equity in your home, you would deal directly with your bank or institutional mortgage lender to seek additional financing.

Chapter 4

How much equity is required to apply for a private mortgage?

Video not working? Watch here on YouTube.

Home equity is one of the most important factors to successfully apply for a private mortgage. The amount of home equity you have will not only determine how much money can be made available to you. The amount of home equity available will also determine rates, lender fees, and broker fees.

What does equity mean?

Home equity is a measure of ownership based on the difference between the current market value of your home versus any existing encumbrances.

Market value of your home

To determine equity, we must first determine the fair market value of a home or property.

Private home equity lenders will require an appraisal, which is performed by an independent certified appraiser. The role of the appraiser is to provide a third party analysis of your home’s value using recent sales in your neighbourhood, called comparables. The appraiser will then make adjustments on the value of your home, up or down based on differences in square footage, quality of finishes, and other market factors with the comparables that have actually sold recently.

Existing encumbrances

Existing encumbrances include any existing mortgages (1st, 2nd, etc.), secured lines of credit, and liens.

When it comes to lines of credit secured on your home, often they are secured in second position behind an existing first mortgage. Even though you might not have any money advanced or owing on the line of credit, it will still occupy the second position and be considered fully drawn when assessing available equity.

In the mortgage origination industry, equity and financing are usually talked about in terms of a percentage called loan to value.

What Does Loan to Value (LTV) Mean?

LTV is the percentage of property encumbered by financing.

For example...

$500,000 outstanding mortgage balance.

$1,000,000 appraised home value.

LTV = $500,000/$1,000,000 = 50%

Putting together your understanding of equity and LTV, we can now discuss how much you can qualify for via a private home equity mortgage.

The more equity you have built up in your home, the stronger your request for financing.

Private home equity lenders serve a very particular niche end of the market with inherent risks. A private lender is only successful if they get their money back. If a default on a loan occurs and they have to take legal action to recover, the more equity available, the more likely they’ll exit with all principal and interest owed.

As loan to value increases, the riskier the mortgage becomes from the private lender’s point of view. This higher risk will get expressed to the borrower with higher rates and fees. Depending on your needs, the price of a private home equity mortgage may or may not be worth it.

The mortgage origination industry and private home equity lenders tier their pricing and fees for certain loan to value ratios.

- Up to 65 per cent LTV: You will find plenty of competition and favourable pricing. Lenders will be a bit more flexible in their underwriting. Use your strong equity position to negotiate with lenders and brokers to get yourself the best deal possible.

- Between 65 per cent and 75 per cent LTV: This segment represents the average private home equity mortgage. Pricing may approach double digits and lenders will be more particular about their underwriting. Some private home equity lenders will not exceed 75 per cent LTV.

- Between 75 per cent and 80 per cent LTV: At this loan to value, the private lenders available in the market will start to get picky about the terms of the mortgage. Pricing will certainly be double digits with lender and/or broker fees as well.

- Over 80 per cent LTV: There are only a handful of private lenders who will go up this high, and if you find one to do it, they will price for the extreme risks they are taking.

Chapter 5

Why second mortgages are the most common type of private mortgage

Video not working? Watch here on YouTube.

While first mortgages can be arranged privately, by far the most common type of private mortgage arranged are known as second mortgages.

What is a second mortgage?

The ranking (1st, 2nd, 3rd etc.) of mortgages is determined by the order in which they are registered on title.

For most Canadian homeowners, they only have a first mortgage which is registered when they purchase their home. As time goes on, they may refinance or perform equity take-outs over the years. However, any subsequent mortgages are registered only after the existing first mortgage is discharged. So, the ranking of their mortgages is always a first.

In fact, banks and institutional lenders almost exclusively deal in first mortgages.

A second mortgage is registered on title when the first mortgage is not discharged.

Similarly, if there is an existing first and second mortgage registered on title and a third mortgage is being arranged without discharging the first two mortgages, then that mortgage becomes a third mortgage.

The ranking of mortgages is significant because under a power of sale or enforcement situation, the priority determines the distribution and repayment of mortgage funds and expenses. Needless to say, second and third mortgage carry more risk than first mortgages for this reason.

Why a second mortgage is useful as a private mortgage solution

In chapter 2, we discussed 4 of the most common reasons why someone might need a private mortgage.

The second mortgage is a quick and cost-effective way of solving some of the common problems borrowers face.

Let’s take, for example, someone who has accumulated debt and fallen behind on credit card payments due to an accident at work.

With missed payments showing on their credit report, the first mortgage lender will not be able to refinance because the credit score doesn’t meet their minimum credit standards.

Furthermore, being out of work recently may have caused annual income to decrease, which is another hurdle for a first mortgage lender to accept.

This is despite our borrower having paid the mortgage on time for the past 10 years, and despite having $100,000 of built-up equity.

Enter the second mortgage

There is no sense in replacing an existing first mortgage at a good interest rate with a bank, because the arranging of the mortgage will trigger higher rates and fees based on the total loan size.

Instead, a smaller second mortgage will allow our borrower to consolidate all their debt into a lower interest rate and monthly payment.

There is an added benefit as well, because all the credit card debt will be paid in full, which allows the credit score to recover quickly.

Chapter 6

How do private home equity lenders in Ontario determine their interest rates?

Video not working? Watch here on YouTube.

Interest rates for private home equity mortgage lenders in Ontario are determined like any other investment. The private lender will evaluate risk vs. reward.

Risk vs. reward is a very fundamental concept in investing and the same applies for the determination of the interest rate on your private mortgage. The higher the risk a lender assumes by selecting a mortgage, the higher the reward, or in this case, interest rate, needs to be to compensate for the risk.

Loan-to-value is king when determining private mortgage rates

The critical defining characteristic of a mortgage is that it is secured debt. That’s important because if a default occurs, a lender can get the court’s permission to sell the property under power of sale to recover the principal and any outstanding interest.

So, when it comes to pricing or rates for private home equity mortgages, loan to value (LTV) is most critical.

| LTV % | Risk Level |

|---|---|

| Up to 50% LTV | Least amount of risk |

| 50% to 65% LTV | Lower risk |

| 65% to 75% LTV | Moderate risk |

| 75% to 80% LTV | High risk |

| 80% LTV or higher | Extreme risk |

So, let’s talk private lender interest rates

Alternative "B" institutional lenders have a higher risk tolerance than banks and typically cut off their rates to borrowers at approximately 5.50 per cent for a one year term.

If 5.50 per cent is the cutoff for institutional money, then private mortgage lenders in Ontario who take more risk need to be compensated accordingly.

Using the LTV table above and adding interest rates to reflect the risk:

| LTV % | Risk Level | Interest Rates |

|---|---|---|

| Up to 50% LTV | Least amount of risk | Less than 7% |

| 50% to 65% LTV | Lower risk | 7% to 8% |

| 65% to 75% LTV | Moderate risk | 8% to 10% |

| 75% to 80% LTV | High risk | 10% to 12% |

| 80% LTV or higher | Extreme risk | 12% plus |

NOTE: It’s worth highlighting that if a borrower needs more than about 65 per cent loan to value, financing is usually broken down into a first mortgage and second mortgage.

If you have an existing mortgage, common practice is to leave your existing first mortgage in place and provide a second mortgage at the approximate pricing indicated above.

A grain of salt

Also, a little disclosure on my behalf. I’m sharing this table as a guide. There may be factors besides loan-to-value that affect the interest rate a private mortgage lender in Ontario will charge. Factors such as term, credit history, income, or other circumstance will certainly affect rates as well.

Chapter 7

How Ontario private home equity lenders determine their lender fees

Video not working? Watch here on YouTube.

When it comes to private home equity lenders, there are various business models and styles of operation.

Some of the most common types of private mortgage lender types include:

- Mortgage investment corporations

- Mortgage administrators

- Private individuals/corporations

- Mortgage syndicates

It is common practice for private mortgage lenders to charge a lender fee in addition to the interest rate.

The fees are typically included to cover operational and administrative costs incurred by the lender to manage and administrate your mortgage.

Lender fees are very discretionary.

In my experience, I find that lenders get away with charging lender fees simply because they can. As a private mortgage home loan borrower, you’re hard pressed to find alternative solutions and lenders know that.

In Ontario, it’s common practice for private lenders to charge a 2 per cent lender fee or minimum of $2,000, whichever is greater

However, over the years I’ve seen some crazy high lender fees over 5 per cent. Why? Again, it’s completely discretionary and a reflection of the difficulty to finance.

If your private home equity mortgage loan request is a strong one where you have a lot of equity, and solid income and credit, you’re unlikely to experience high fees.

However, if you’re asking for 85 per cent LTV and find a lender willing to take the chance and provide you with financing, chances are you’ll pay a high lender fee as a reflection of the difficulty and risk associated with the mortgage.

Is it possible to find a private lender that doesn’t charge a lender fee?

It’s a bit of unicorn, but they do exist.

Some of the true private lenders who are individuals operate much more simply and forego lender fees.

From my own experience, we tend to lower and accommodate our lender fees and sometime waive them if the opportunity arises.

Chapter 8

Mortgage brokers, why you need one, and their fees for arranging a private mortgage

Video not working? Watch here on YouTube.

There is an entire industry and network of private mortgage lenders throughout Ontario. Many of them are highly specialized in niche areas such as:

- Geography

- Maximum loan to value

- Construction renovation financing

- Short-term vs long-term

- Open term vs closed term

- Minimum mortgage amounts

- Maximum mortgage amounts

Private lenders generally don’t advertise to the public or even have client facing customer relations or origination channels. Instead, they rely on a network of mortgage brokers to find and recommend clients.

So as a borrower searching for a private mortgage solution, your best bet is working with a mortgage broker.

Your broker should be able to listen to your needs and assess the best plan of action. Brokers have a fiduciary responsibility to you to make sure they are exploring all options in your best interests to find you the most economical and suitable solution. Your broker will not only source the financing you need, but also advise on how to pay off the high interest debt and explain the risks if the private mortgage is not paid back in full.

How your mortgage broker gets paid to arrange a private mortgage

Private mortgage lenders do not payout commissions or finder's fees to mortgage brokers who bring them business. Instead, common practice is for brokers to charge a fee on top of the lender fee as compensation for arranging your private home equity mortgage.

As a general rule of thumb, mortgage brokers match the fee charged by the Ontario private lender.

The greater of 2 per cent of the principal amount, or approximately $1,500, depending on the degree of difficulty

There is discretion on this fee and it certainly can be negotiated as part of your deal. As the mortgage amount increases, there might be the ability to lower the 2 per cent.

However, if your mortgage amount is lower, it’s difficult to negotiate because whether your private mortgage request is $25,000 or $250,000 there is almost the same amount of work required.

Choosing a mortgage broker for your private mortgage

In Ontario it’s necessary to arrange financing through a licensed mortgage broker.

In selecting your broker for a private home equity mortgage, it pays to shop around a bit.

It's not just about the fees and "low" rate

Your broker should be someone who truly looks out for you and your best interests, and understands how to evaluate your situation.

It’s easy to get someone into debt but difficult to get out of that debt. Your mortgage broker should be someone who comes up with a comprehensive plan to guide you through the private mortgage process and is still there at the end of the term to move you back into mainstream financing at the bank.

Apply Now

Whether you are looking for expert mortgage advice or just have general questions about our service, we are here to help.