Looking to build a home or renovate in Toronto? A construction mortgage is the ticket. This guide covers how construction mortgages work, from stage-based fund disbursements to specialized construction mortgage loan program types available from Canadian banks and mortgage lenders. On this page you’ll learn the benefits and use cases of construction mortgage financing, steps to get approved and various financing products available to successfully finance the completion of your project.

Key Takeaways

- Construction mortgages provide flexible financing tailored specifically for building, renovating or adding an accessory dwell unit (ADU), with funds disbursed in stages or draws based on project completion.

- Eligibility for construction mortgages relies on establishing an “as complete” valuation, credit score, financial stability, and detailed construction plans, requiring a thorough documentation process for approval.

- Choosing the right lender and product is critical to the success of your new build. There are different types of lenders each with their own strengths and weaknesses to consider. Seeking expert advice can help you find the right construction mortgage lender for you.

Understanding Construction Mortgages in Toronto

Residential construction and renovation projects of any size can be expensive. Finding the right financing tool in Toronto’s dynamic real estate market to facilitate construction can make a difference to the success of your project. Construction financing is designed to address the unique needs of building a home or undertaking substantial renovations, offering flexibility and customization that traditional mortgages simply do not. Unlike traditional mortgages, which provide a lump sum to purchase an existing property, construction mortgages disburse funds in stages as work progresses, ensuring that funds are available when they are needed. This draw process ensures that financing costs are minimized because borrowers typically only pay interest on the funds advanced and is the most efficient way to manage costs and risks for both lenders and borrowers.

A construction mortgage is tailored to the construction phase, making it ideal for financing projects of all sizes big and small including accessory dwelling units (ADUs) such as landway suites and garden suites. The loans come with distinct features such as interest-only payments during the construction period and staged disbursements, known as construction draws, which are subject to inspection and approval by the lender.

In Toronto, various types of construction mortgages are available to cater to different needs, including

- construction mortgages

- second mortgages

- the secondary suite refinance program

- purchase plus improvement mortgages

- secured lines of credit

Each type of loan has its own strengths and weaknesses. Sometimes they are used in combination. We’ll review all the details a little further on.

What is a Construction Mortgage?

Lets begin by defining exactly what a construction mortgage is?

A construction mortgage is a specialized financing product designed specifically for the construction or significant renovation of a home or investment property. The main defining characteristic of construction financing is that funds are advanced in stages or draws over time as work is completed. These incremental disbursements align with the construction phases, allowing for better cash flow management and ensuring that funds are available as needed throughout the project.

The reason construction mortgage lenders do this is because they are lending on a future ‘as completed” project that does not exist yet. Since it hasn’t been built there is additional risk for the lender who is relying on the property as collateral. Therefore the lenders will advance money as work is completed based on a percentage of completion basis.

In addition to the draw process other key features and characteristics of construction mortgages include:

- interest-only payments during the construction phase. This payment structure helps borrowers manage their finances more effectively during the construction process, easing the financial burden until the project is completed and the mortgage converts to a permanent loan.

- heavy importance placed on the “as complete” value of the property and

- the exit strategy or take-out financing once the project is completed.

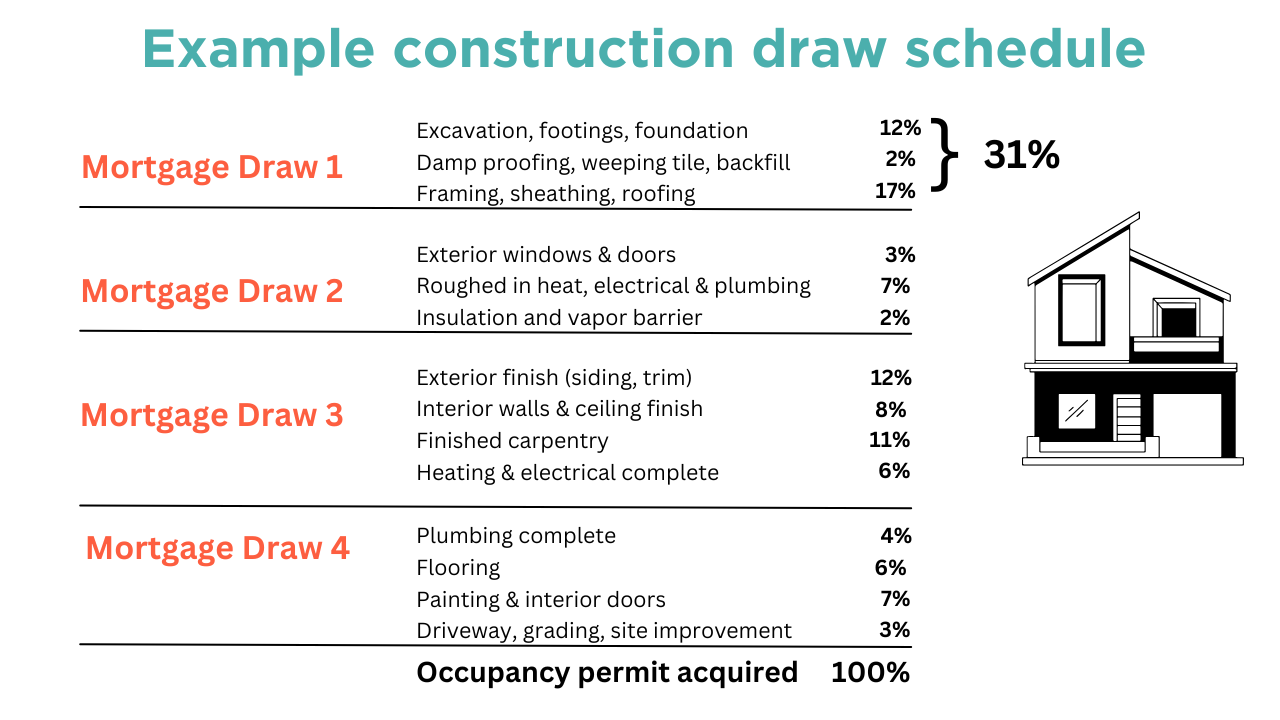

Construction Draw Schedules

A construction draw schedule details the timing of payments during the building process. Before construction begins, you and your contractor negotiate this schedule. While lenders often have standard draw schedules, changes and alterations may be proposed based on the variations in construction timelines or costs or your unique project. Payments are typically tied to specific milestones, such as completing the foundation or roof, or based on the percentage of the project completed.

Interest accrues only on the funds disbursed with each draw, which makes the timing of payments significant. Borrowers may aim to delay draws to minimize interest costs, while contractors generally prefer earlier payments to maintain project cash flow.

For more in-depth analysis about the draw process checkout my video here:

How does the construction draw process work?

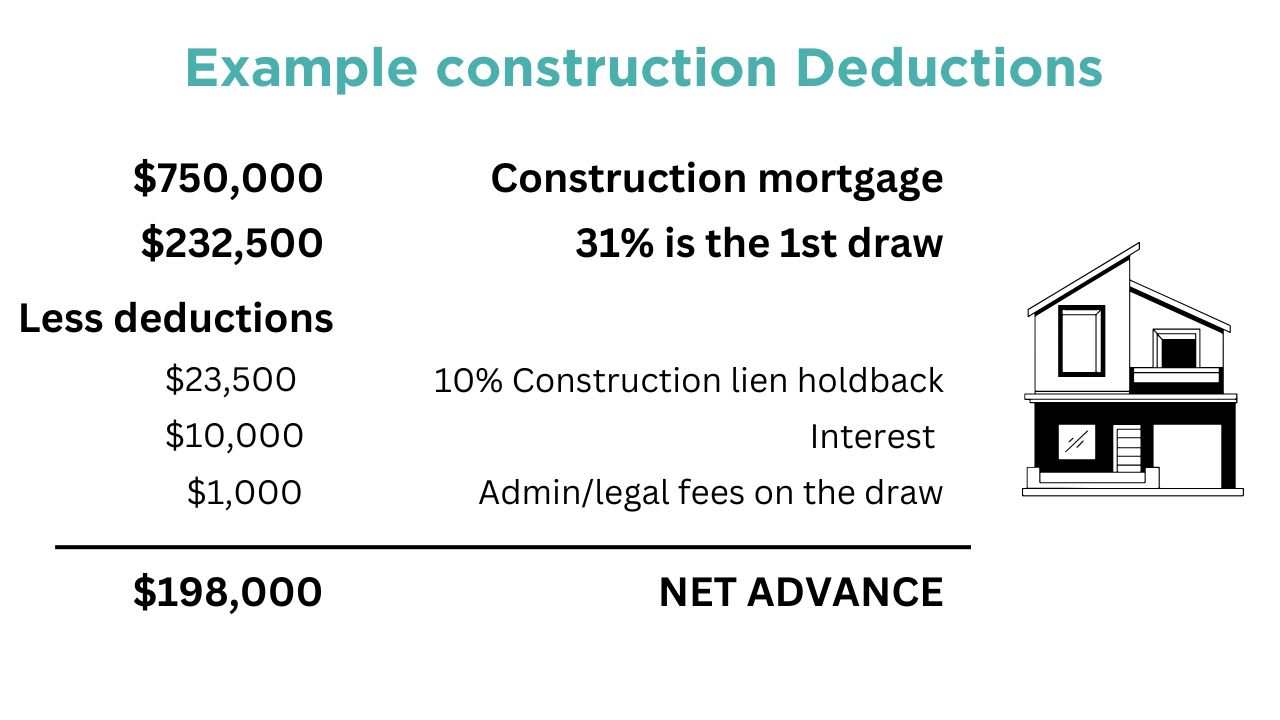

Example of a Construction Loan Mechanics:

An appraiser determines the “AS COMPLETE” value of your project will be $1,000,000.

Through a construction mortgage lender we have arranged a construction loan up to 75% loan-to-value (LTV) of the projected value. EG $750,000.

*NOTE: in this scenario for simple illustration you own the property out right with no mortgage on the land or property.

The agreed upon schedule looks like this:

After the first 90 days of work the agreed upon items from the schedule are completed and you ask for the first draw from the lender.

The first draw minus deductions will look like this:

The exit strategy

This process of advancing money as work is completed will continue until the project is complete. Construction financing is not designed or meant as long term financing. So as soon as you get your occupancy permit you’ll want to make arrangements to arrange your take-out mortgage.

If you work with a bank or financial institution the take-out mortgage is arranged as part of the overall package.

If you work with a private or specialized construction mortgage lender then the take-out mortgage will have to be arranged separately.

Of course there are some construction projects that are taken on as investments and meant to be sold after completion.

Managing Construction Financing During the Building Phase

Managing construction financing during the building phase can be challenging. Having the right preparation and understanding upfront can help to mitigate cost overruns, unexpected challenges and managing the timing. Here’s some

Construction Draw Schedules

Draw schedules are crucial for structuring payments to contractors, ensuring financial resources are allocated efficiently as work progresses. The example above is a very standard schedule however lenders and borrowers may tweak the schedule based on unique circumstances around your project. This schedule helps in planning the financial aspects of the project and ensures that funds are available at the right times.

Accessing Funds

In order to access funds and inspection is typically required. An appraiser or lender representative checks the progress of the home before each construction draw is paid through your lawyer, to ensure that the work is on track and meets the required standards.

10% Construction Lien Holdback

In Ontario there is a Construction Lien Act that protects contractors from non-payment or payment disputes. The Act requires that during the construction phase 10% of the construction financing is held back by the lawyer. Once the project is complete and a certificate of completion is issued by the municipality there is a waiting period of 60 days for unpaid contractors to come forward and secure a lien. If no liens are registered then the 10% holdback is released to the home owner. This structured approach helps manage the construction process effectively, mitigating risks associated with delays and cost overruns.

Interest Only Payments During Construction

Interest-only payments during the construction phase can significantly lower monthly payments, enhancing cash flow management. This payment structure allows borrowers to focus their financial resources on the construction process without the added burden of full mortgage payments.

Interest begins to accrue once each construction draw is disbursed, allowing borrowers to plan their finances effectively. Some lenders may allow future construction draws to be used for loan interest payments, which can further assist in managing cash flow.

Borrowers might choose to receive draws later in the construction phase to reduce overall interest costs, optimizing their financial strategy.

Construction Mortgage Costs

Aside from the interest on your construction loan there are some costs associated with arranging construction financing that you should consider and plan for. Note that the following costs do not apply to every construction loan type however it is an exhaustive list and one you should refer to when planning your construction project:

- Legal fees & disbursements

- Draw admin fees from the lender

- Appraisal fees

- Lender fees

- Broker fees

- Title insurance

Handling Unexpected Expenses

Having contingency funds between 10% to 20% is crucial. Unexpected expenses can arise during construction, making it vital to include a contingency fund in the overall project budget. This fund ensures that unforeseen costs do not derail the project and allows for smoother financial management. Some construction mortgage lenders require you to demonstrate that you have sufficient financial assets to cover contingencies.

Effective communication with lenders and construction firms is crucial to avoid financial challenges during a construction project. Detailed planning and realistic budgeting are essential to cover all potential expenses and manage finances effectively.

Applying for Construction Mortgages in Toronto

Securing a construction mortgage in Toronto involves meeting specific qualification criteria. Lenders assess various factors to determine a borrower’s suitability for a construction loan, including the “as complete” value of the project, credit score, financial stability, experience and the viability of the construction project.

In addition to the standard qualification requirements for mortgage financing, lenders will evaluate each application to ensure that the borrower can cover interest payments during the construction phase and future mortgage payments once the construction is complete.

Lenders need to see comprehensive architectural designs, necessary permits, and a well-prepared budget that includes a contingency fund for unexpected expenses. These documents help lenders evaluate the feasibility and risks associated with the construction project.

The “As Complete” Value

When applying for a construction mortgage there are limitations to the maximum amount a lender is willing and able to give you. Step #1 is to make sure that the maximum loan amount available is greater than the budget required.

To do this you need to know 2 important numbers…

1) the “as is” value of your real estate and

2) the “as complete” projected value of your real estate once the construction is complete.

Based on these figures you can expect to qualify for a maximum construction mortgage amount up to approximately 75% to 80% of the as complete value.

For full analysis check out my video below: Construction financing: Understanding loan-to-value and exit strategy

Down Payment & Equity Requirements

Down payment and equity requirements are crucial elements in the construction mortgage application process.

If you are buying a property with the intention of doing construction immediately most lenders require a substantial down payment. Ideally you are able to purchase with at least 25% to 35% down payment.

If you already own a home then traditionally lenders will want you to have built up equity between 25% to 35%. However new for 2025 the federal government introduced a CMHC insured Secondary Suite Refinance program that allows qualified borrowers to access up to 90% of the ‘as complete’ value of the project. For more information on the Secondary Suite Refinance program: Unlocking the Potential of Laneway Houses in Toronto | New 2025 Mortgage Rules Explained

Credit Score

A good credit score is critical in securing a construction mortgage. Most lenders look for a credit score of at least 680 to ensure favorable terms. A lower credit score may limit access to these loans or result in less favorable terms and conditions from the construction mortgage lender.

Detailed Construction Plans and Budget

Detailed construction plans and a realistic budget are vital for securing a construction mortgage. Essential documentation includes detailed architectural designs, necessary permits, and a comprehensive budget that outlines all construction costs. These documents help lenders assess the viability of the construction project and the builder’s qualifications.

A signed contract with the builder and financial statements from the builder are also crucial components of the application. Including a contingency fund in the budget is important to cover unexpected expenses and avoid financial instability during the construction phase.

Lenders assess construction mortgage applications based on the viability of the proposed project and the builder’s credentials. Meeting lender requirements through detailed planning and a realistic budget is crucial for the success of a construction mortgage application.

The Application Process for Construction Mortgages in Toronto

The application process for construction mortgages in Toronto is more complex than that of traditional mortgages. It involves several clear steps, including the preparation of detailed documentation and undergoing lender assessment and approval. Each of these steps is essential to ensure the successful approval of the construction mortgage.

Working with a mortgage broker can enhance your chances of securing favorable interest rates and terms for construction mortgages. Brokers provide access to a wider range of lenders, offering alternative financing options beyond traditional banks.

Preparing Your Documentation

For a successful construction mortgage application, specific documents are essential. The materials include detailed construction plans and a well-prepared budget. Additionally, there is a timeline for project completion. These documents provide lenders with a clear understanding of the project’s scope and feasibility.

The following is a documentation checklist to get you started:

- Architectural plans and drawing

- Budget

- Quote from builder/contractors

- Confirmation of liquid or financial assets

- Permits (as available)

- “As is” appraisal

- “As complete” appraisal

- Confirmation of income

- Credit report

- ID

Working with a Mortgage Broker

There are multiple channels you can use to secure construction financing. Some of the BIG 5 Canadian banks provide construction financing while others do not. It is possible to approach your branch however to get a comprehensive overview of all of your options for consideration working with a mortgage broker is valuable.

Engaging a mortgage broker also provides access to alternative financing options beyond traditional banks. Brokers can offer expert guidance, helping you navigate the complexities of construction financing and ensuring you avoid common pitfalls.

Eligible Projects Types That Require Construction Loans

Understanding and defining exactly when a construction loan is required vs a traditional mortgage might be a bit confusing. Home improvement projects can be as modest as an interior renovation, the build-out of an addition, a complete rebuild from foundation up or even the construction of a new structure such as an accessory dwelling unit.

Let’s run through a few scenarios and highlight the most suitable financing product for the job.

Minor Renovations

If your home improvement project is more modest and cosmetic to the interior like a renovation or kitchen/bathroom remodeling then construction financing as we’ve been discussing on this page isn’t really the right solution.

Financing solution: a line of credit, refinancing of your existing mortgage or even a 2nd mortgage would be the best ways to finance this type of project.

Purchase Plus Improvement

If you are about to purchase a home and immediately want to do some cosmetic improvements then there is a specialty program called purchase plus improvements. This program allows you to add renovation costs to your mortgage when you purchase a home. For example you could purchase with as little as 5% down payment and get some additional funds from the lender to update a kitchen or bathroom etc

Financing solution: Purchase plus improvement. Allows you to purchase with minimal down payment add part or all of the renovation costs to the mortgage upfront.

Major Renovations/Addition

When considering a larger renovation such as a “total gut job” or the construction of an addition that changes the foot print then more specialized financing may be required. This depends on how much equity you have built up in your home and size & budget of your addition.

Financing solution: a line of credit, refinancing of your existing mortgage, a 2nd mortgage or construction financing with draws.

New Build

If you are building on vacant land or completely demolishing an existing home and rebuilding from scratch then you’ll start to need true construction financing. Banks and lenders will not be comfortable providing a traditional mortgage because while the construction is taking place the value has not yet been created in the property for them to secure their mortgage.

Financing solution: Construction mortgage from a specialized construction mortgage lender or bank program.

Accessory Dwelling Unit (ADU)

ADUs include laneway housing and garden suites. Since they represent the construction of a second structure on a property and the existing home remains standing there are a few creative ways to finance the construction of these units. There are also some specialty loan programs available through the federal government and municipalities that make cheap capital available.

Financing solution: a line of credit, refinancing of your existing mortgage, a 2nd mortgage or construction

financing with draws.

Advantages and Challenges of Construction Mortgages in Toronto

Construction mortgages offer several advantages, including customization, control over timing, and financial flexibility. These loans allow homeowners to tailor their home construction projects to specific needs and preferences, providing flexible financing options that can adapt to the project’s unique requirements.

However, construction mortgages are generally considered riskier for lenders due to the difficulties in selling unfinished properties and the potential for cost overruns and project delays. The application process can be more complex and time-consuming compared to traditional mortgages, requiring detailed plans and ongoing scrutiny by lenders.

Customization and Flexibility

Flexibility and customization are key benefits of construction mortgages, allowing homeowners to design and build their dream homes to exact specifications. This level of control ensures that the final product meets the homeowner’s vision and needs.

Higher Interest Rates Compared to Conventional Mortgages

Construction loans typically come with higher interest rates. This is in contrast to standard mortgages. This is due to the increased risk associated with financing an unfinished project. Borrowers must be prepared for these higher rates and consider them when planning their construction financing strategy.

Detailed Planning and Potential Risks

Detailed planning is crucial for construction projects, as it helps outline the project’s scope, timeline, and budget. Lenders evaluate the viability of construction projects by assessing the associated risks and costs, making thorough documentation essential for securing financing.

Common risks in construction include cost overruns and project delays, which can affect project financing. Mitigating these risks through detailed planning and thorough documentation can aid in securing financing and ensuring project success.

Choosing the Right Lender for Your Construction Mortgage

Choosing the right lender is essential for securing favorable terms and ensuring a smooth construction process. Selecting the right lender affects funding, disbursement timelines, and project execution, making it critical for project success.

Types of construction mortgage lenders include:

- Banks (note: not every bank can accommodate construction loans)

- Credit Unions (note: not every C.U. can accommodate construction loans)

- Specialty Construction Mortgage lenders

- Private Mortgage Lenders

Comparing Multiple Lenders

Comparing different lenders based on their terms, services, and previous experience in the construction mortgage field is important. This process involves evaluating not just rates but also the quality of service and the lender’s history with construction loans.

Before applying for a construction mortgage, it is essential to assess the terms, rates, and fees of various lenders to find the most favorable deal. Comparing lenders involves evaluating not just interest rates but also terms and service quality.

Researching online reviews and ratings can provide insights into a lender’s reliability and service quality. By carefully evaluating both offers and reliability, you can make an informed decision on the best lender for your construction mortgage.

Importance of Expert Advice

Expert advice is crucial for individuals navigating construction financing, ensuring they make informed decisions. Consulting with mortgage professionals can help understand complex financing options and avoid potential pitfalls, enhancing decision-making.

Evaluating Lender Reputation and Experience

A lender’s reputation can significantly influence the terms and reliability of a construction mortgage. Evaluating a lender’s experience with construction mortgages by reviewing their track record in handling similar projects ensures a well-informed choice.

Summary

In summary, construction mortgages offer a unique and flexible financing option for building or renovating homes in Toronto. These loans provide the necessary funds in stages, aligning with the construction phases and easing financial management. However, securing a construction mortgage involves meeting specific eligibility criteria, detailed planning, and understanding the complexities of the application process.

Choosing the right lender and seeking expert advice are crucial steps to ensure the success of your construction project. With careful planning and informed decision-making, you can navigate the challenges of construction financing and build your dream home in Toronto.

Frequently Asked Questions

What is a construction mortgage?

A construction mortgage is a specific type of financing for building or major renovations, providing funds through staged disbursements that correspond to different phases of the construction process. This ensures that you have the necessary support at each step of your project.

How do construction mortgages differ from traditional mortgages?

Construction mortgages differ from traditional mortgages in that they provide funds in stages based on construction progress, rather than as a lump sum for purchasing existing property. This approach helps manage financial risk and aligns funding availability with construction needs.

What documents are needed for a construction mortgage application?

For a construction mortgage application, you will need detailed construction plans, a budget, necessary permits, a signed contract with your builder, financial statements from the builder, and a contingency fund for unforeseen expenses. Having these documents prepared in advance will streamline the application process.

Why are interest rates higher for construction loans compared to conventional mortgages?

Interest rates for construction loans are higher because they carry more risk due to the uncertainty of financing an unfinished project. Borrowers should factor this into their construction financing plans.

How can I choose the right lender for my construction mortgage?

Choosing the right lender for your construction mortgage involves comparing multiple options based on their terms, services, and experience. Researching online reviews and obtaining expert advice are essential steps to ensure you make an informed decision.