Will rising rates cool this market down?

While we’ve been closely watching the extreme GTA real estate market, something noteworthy has been happening with interest rates. Fixed-rate mortgage rates have increased from ~1.69% to 2.44% in the span of three weeks.

What do rising rates mean for the housing market? If this increase to fixed-rate mortgages persists, the GTA market might start to cool as it loses some of its pepper.

Why are fixed rates increasing?

Remember, banks don’t control the pricing of fixed-rate mortgages.

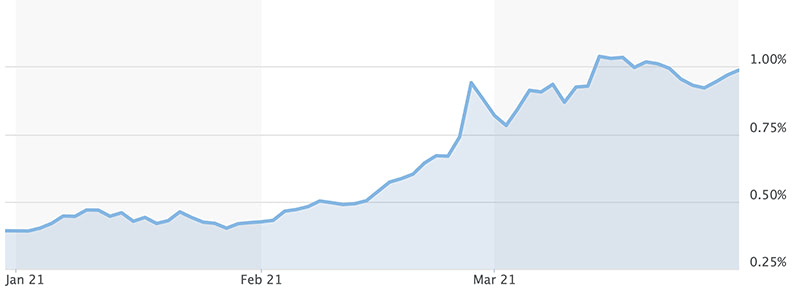

Fixed-rate mortgages are based on bond yields, and bond markets have been on an upward trend in March as shown below. (source)

A quick crash course on bonds.

Governments and businesses issue bonds as a way to borrow money – think of a bond like an I.O.U.

Pre-pandemic, there was already an estimated $10.5 trillion (USD) in US corporate debt issued through bonds.

COVID-19 created a golden opportunity for businesses in need to pile on more cheap debt via bonds. Government backing and incentives have created historically low borrowing costs.

What happens when government support ends?

As vaccine rollouts continue and economies around the world reopen, bond traders are seeing signs that we might get back on our feet sooner than expected. That’s good news – but it also means governments will end their extraordinary intervention in support of the bond market.

Zombie businesses.

Many businesses rely on this life support of cheap borrowing costs right now. If rates go up, so will the bellies of these businesses, which bond traders fear could lead to a recession.

It’s because of this increased future risk that bond traders are demanding higher and higher yields.

On the other hand…

Despite all these fears, the Bank of Canada and Federal Reserve in the US have both stated their commitment to supporting the economy. They’re projecting at least two years before any changes are made.

This is why a variable-rate mortgage, priced anywhere between 1.20% to 1.45%, is a good option right now. That’s more than a 1% spread between fixed and variable rates. I can’t recall the last time I saw that differential over the last 16 years of my career.

Snippets

- What Canadians think: 50% of Canadians think now is a good time to buy in their community. This and other consumer trends in the most recent residential housing market survey.

- Hold the assessments: Ontario’s 2021 budget includes postponing property tax reassessments to give businesses and households relief from future uncertainty.

- Bring in the “sacred cows”: Imposing capital gains and other drastic measures on your home? RBC thinks it’s a good idea.

- Bubble trouble: Banks could help deflate Canada’s hot housing market. Here’s who – and what – is causing the delayed action.