Last week’s Bank of Canada announcement was the most anticipated since the pandemic began.

Inflation and interest rates have dominated every business headline for weeks now, putting pressure on the Bank of Canada to flex its muscles to calm fears.

If you missed my most recent Bank of Canada update, you can catch up here.

Why do inflation and rates matter so much?

Whether you have rising inflation or rising rates, at the end of the day your dollar will buy you fewer goods and services.

This is especially true when it comes to real estate. As inflation increases, home prices accelerate, but rising interest rates also mean that borrowers qualify for less and less financing.

The Bank of Canada was very measured with their response.

The most significant headline was a fast-tracking of the timeline for possible rate increases, from mid-to-late 2022 revised to early-to-mid 2022. Think April.

Now, the debate rages about how often and by how much the BoC will increase rates in the future. Economists are split on the speculation.

Some very aggressive forecasting by economists has made headlines, predicting a 2.50% increase to the prime rate in the next 12 months.

Personally, I don’t share the view that rates will increase as quickly as predicted.

Here are 3 reasons why I believe rates will remain moderate in the coming months:

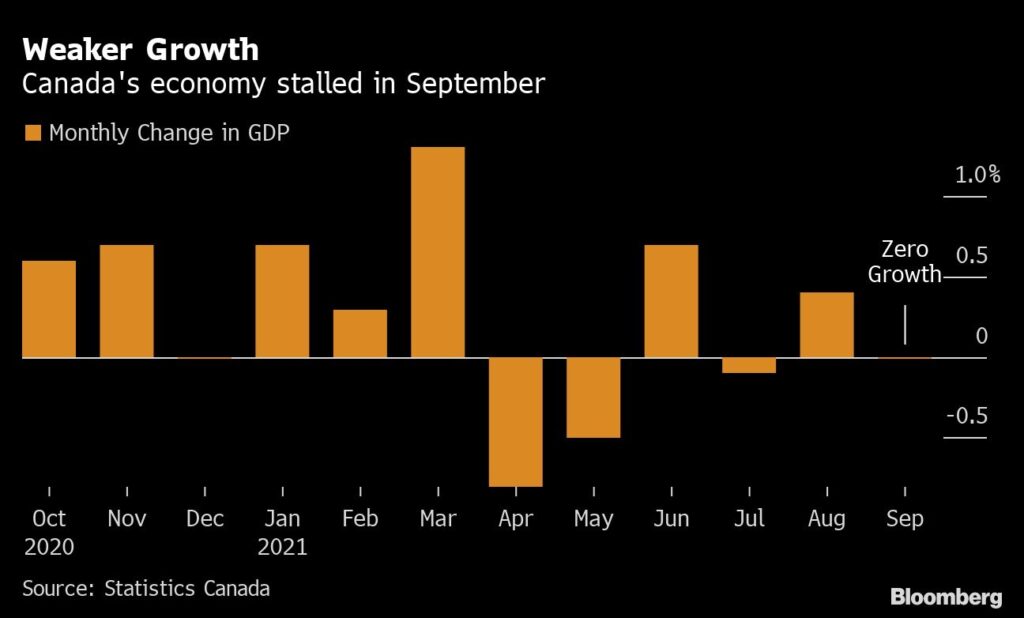

1- Economic growth is fragile and there are signs showing slower than expected growth.

(Source: Bloomberg)

The central bank is walking a very fine line because if they raise rates too aggressively, as some are suggesting, they risk stalling economic growth entirely. The economy will be very sensitive to rising interest rates. I would anticipate one to three 0.25% increases over the next 18 months, but nothing near the predictions of six to eight increases making headlines at the moment.

2- Inflation can’t be easily addressed by higher rates.

At least, not the type of inflation that we are experiencing around the world right now. Economists are arguing that the type of inflation we have is “transitory,” ultimately caused by a confluence of factors relating to pandemic shutdowns.

In October Frances Donald, chief economist at Manulife quipped:

“The Fed can hike interest rates all it wants, it’s not going to make it rain in Brazil, open ports in China, find truck drivers in the UK, change covid-0 policies in Australia. Bet that the Fed will hike rates if you want, but don’t bet it will help this supply-driven inflation.”

3- Inflation exists in the mind.

Remember when the pandemic hit, and for some reason people started panic buying toilet paper? It led to some pretty deplorable scenes of humanity and shockingly bare shelves at grocery stores. The reality was there was no shortage, but consumer behaviour manifested a shortage.

The same phenomenon exists with inflation. If you believe that the price of a widget will be more in the future than it is today, then you’ll have an incentive to buy today even if you don’t need it. This creates further shortages of supply, which drives prices up unnecessarily.

The projections for rate increases assume that the headlines and risks will stay the same, but we’re living through some very interesting times. A surge in COVID-19 cases this winter and lockdown measures would surely put a pin in any rate increases, not to mention any other headline risks that could change attitudes very quickly.

I’m here to support you.

The door is always open for you! If you need any kind of support, need help understanding interest rates, or want to chat about your options, I’m just a phone call or email away.

The best way to get in touch is via my booking calendar below.