There is no such thing as a silly question. What amortization period means is a great one. Very often mortgage professionals will fly over financing terms that haven’t been properly introduced to borrowers, making an assumption that the terminology is understood.

Here is the low down on amortization periods.

The amortization period is the length of time it takes to pay off a mortgage in full. It’s that simple.

At one time in Canada it was possible to arrange mortgages with a maximum amortization up to 40 years. Today the maximum amortization period has been limited to 25 years for high ratio mortgages and 30 years for conventional mortgages. If you know where to look there are still one or two lenders still quietly offering 35 year amortizations.

The amortization period is important to your mortgage because the length of the period effects your monthly payment amount and the amount of interest you pay to the lender over the life of the mortgage. Although a longer amortization period means lower mortgage payments, it is to your advantage to choose the shortest amortization – that is, the largest mortgage payments – that you can afford. You will pay off your mortgage faster and will save thousands or even tens of thousands of dollars in interest in the long run.

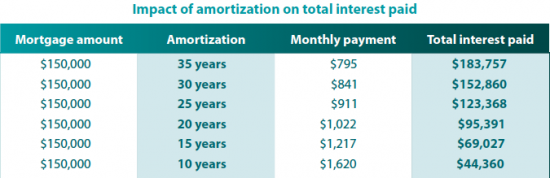

Consider the following table. It shows how much interest is paid (over different amortization periods) on a $150,000 mortgage, assuming a constant annual interest rate of 5.45%.

From the table above you can understand a couple key points about your mortgage financing and the amortization period:

- increasing your payment by just $46 from $795 to $841 per month means you would be mortgage free

five years earlier and save over $30,000 in interest charges; - increasing the monthly payment by $116 from $795 to $911 would allow you to be mortgage

free 10 years earlier and save over $60,000 in interest.

Question about your mortgage or looking to work with a mortgage broker? Use the contact bar on the side of this page to write me instantly or visit my testimonials page to hear what my clients have to say about me. I look forward to hearing from you.