Mortgage interest rate update for October 3

Do you know why you are looking for the lowest mortgage interest rate? Because interest rate is the price of the money you borrow. And all things being equal you want the best price for any product or service you buy.

Right now if you are shopping for a mortgage to buy a home, refinancing debt or renewing your existing mortgage you are going to have the opportunity to lock-in to some of the lowest rates historically available.

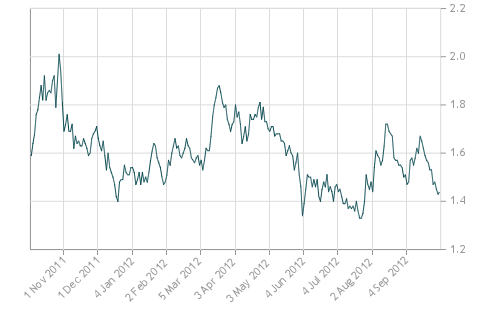

How do we know this? Because it’s the government of Canada bond yield that allows us to determine where fixed rate mortgages are headed. Consider the following graph of the Government of Canada 5 Year Bond Yield over the past 12 months.

The graph shows 3 low points. The first is January 2012. The Second June 2012. The 3rd and final is the end of September and the trend has continued into October. Those 3 low points are precisely when historically low 2.99% fixed 5 year rates became available for mortgage financing. The same trend has developed for other terms as well including 3 year terms and 10 year terms.

The graph shows 3 low points. The first is January 2012. The Second June 2012. The 3rd and final is the end of September and the trend has continued into October. Those 3 low points are precisely when historically low 2.99% fixed 5 year rates became available for mortgage financing. The same trend has developed for other terms as well including 3 year terms and 10 year terms.

Here are my picks for this week from longest term to shortest.

If you want long term stability in your mortgage consider a 10 year fixed at 3.89%

For your medium term I have the ever popular 5 year fixed priced at 2.99%.

Finally for your short term needs consider this well priced 3 year fixed at 2.69%.

All 3 of these fixed rate options are priced at their historical lows. If you are looking for another term visit my interest rate page for a complete offering of rates.

If you are considering buying this fall, contact me here or book a call into my calendar below.