Key points from the June 2023 Bank of Canada announcement:

- The Bank of Canada surprised markets today with a 0.25% increase to their policy rate

- Stronger than expected jobs, GDP growth and inflation are working against the Bank of Canada’s attempt to slow the economy.

- The policy rate is now 4.75%

- The retail prime rate (what you and I pay) will increase to 6.95%

The Bank of Canada announces a ¼ increase to the prime rate.

The BoC opted to “rip off the bandaid” today. Markets weren’t expecting the increase at today’s meeting, but rather the next meeting in July. Rather than wait and see, the BoC took immediate action and increased rates in an attempt to slow down a fast paced Canadian economy.

You can read the full press release here.

RATE FORECAST

The future of Canadian mortgage interest rates has been murky at best over the past 45 days.

During the last BOC meeting the expectation was that high interest rates and inflation would push the Canadian economy into a recession in late 2023, and rates would soon fall.

The reality is that the Canadian economy is showing a lot of stubborn resilience and strength:

- Job numbers continue to impress and unemployment remains at all time lows.

- Q1 2023 GDP out-performed all estimates at 3.1%.

- Inflation in April came in hotter than expected.

The confluence of these factors over the past few weeks has flipped the script on interest rates.

Higher rates for longer into the future.

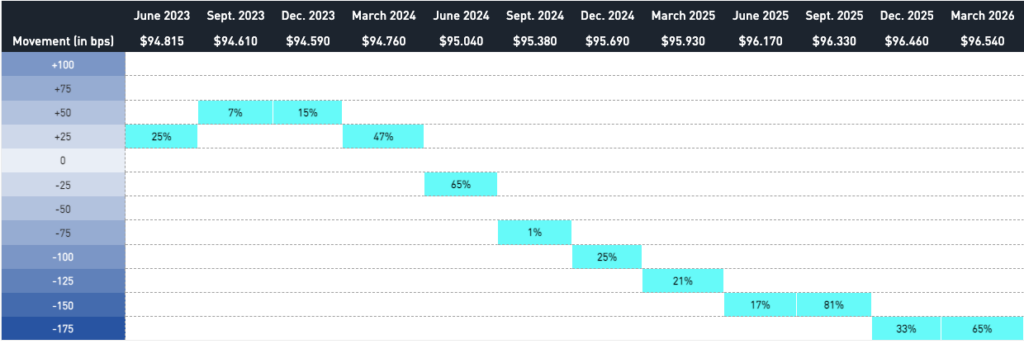

The chart below shows the implied short-term interest rate movements and probabilities based on the movement of certain Canadian financial instruments.

It shows that traders expect a 100% likelihood of at least a +0.25% increase to the Bank of Canada overnight lending rate in Q3 & Q4 of this year. In fact, they are even starting to price in the possibility of +.50% increases.

I share it to help set expectations into the future. Higher rates for longer into the future.

The narrative around the North American economy is starting to change. We expected a crash landing and recession. Just think about the banking concerns 60 days ago.

Now there is growing data to suggest that central bankers might be able to achieve the impossible – a soft landing.

Personally, I’m coming around to the view that current rates between 5%-6% are the new normal for the indefinite future.

If you would like to get in touch about today’s announcement or your mortgage, you can contact me here or book a call in my calendar below.