The rules governing mortgage qualification and lending are constantly in flux. Mortgage regulators react to the ever changing needs of borrowers and the associated risks to lenders and markets. Over the past 10 years alone there have been 8 rounds of rules changes which have impacted Ontario borrowers.

Nothing has stayed the same long enough to get used to!

The challenge is keeping up with the changes.

The Canadian mortgage industry is very much like an iceberg for the average Canadian.

Dealing with banks and brokers is just the tip of the proverbial iceberg that is visible above the water line. The true “business” of mortgages happens invisible to borrowers and is not often understood or explained. This includes vast movements of capital in the mortgage backed securities market which require mortgage default insurance and backing by the Federal government.

Some changes are bigger than others.

While some of the modifications to mortgage rules are simply tweaks and adjustments, others are more significant.

One significant change was introduced December 1st 2016. The change essentially turned the mortgage market on its head and created a new language to talk about mortgage types.

TELL ME MORE ABOUT THE DEPARTMENT OF FINANCE CHANGE DECEMBER 1st 2016

Here’s what you need to know.

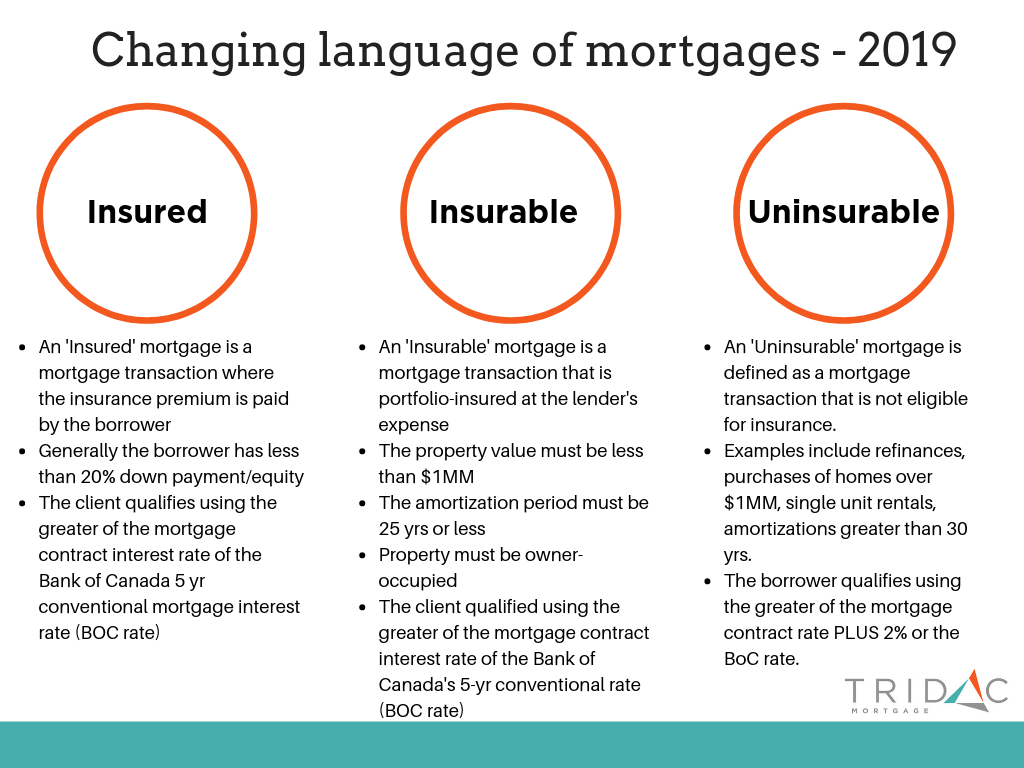

The changes mean that mortgages are now categorized into one of 3 buckets:

INSURED

INSURABLE

UNINSURABLE

As you can see, this language wasn’t developed with the consumer in mind. It certainly doesn’t help that all 3 contain “INSURE” in the name.

Each bucket has a defined set of parameters and most importantly to you, interest rates. For a consumer this has been the cause of significant confusion. No longer is it possible to just ask the question: what is the best 5 year fixed rate mortgage?

To be an informed consumer it’s worth understanding which of the 3 buckets you fit into:

Insured, Insurable & Uninsurable interest rates.

If you’re shopping around for a mortgage rate online it’s important to understand that some rates are exclusive to certain buckets. Here’s what you need to know:

- Insured – Because the borrower pays the mortgage insurance premium, this actually lowers the risk for the lender. The lowered risk is reflected by the lowest and most discounted rates in the market. Generally speaking, when you see a low rate advertised chances are it is for an insured rate, so be aware.

- Insurable – These rates aren’t quite as low as insured rates because the lender is paying the insurance cost and that gets reflected through a higher rate. Generally +0.10% to +0.20% higher than insured rates.

- Uninsurable – Uninsurable mortgages aren’t as liquid or economical for lenders as the other two categories. That gets reflected in the highest rates. Again typically 5 yr rates are +0.10% to +0.20% higher than insurable rates.

Value of a mortgage broker.

In the current rate environment with such a fragmented and complicated market place a good mortgage broker can provide great guidance.

Unlike your banker who only sells one lender’s product, a broker has relationships with multiple lender partners, each of which is competing to attract your business.

Whether you’re shopping for the best insured rate, insurable rate or uninsurable rate, a broker can get you to the best solution.

You can book a call directly into my calendar below.