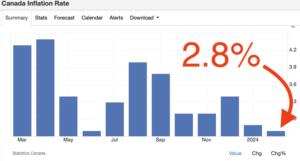

Join me as I discuss the inflation rate for February, which came in at 2.8%, lower than the previous month and below the expected 3.1%.

This indicates a positive trend influenced by the high interest rate policy of the Bank of Canada.

Food prices contributed to the decrease in inflation, while gasoline prices and shelter costs remained high.

Despite the better-than-expected inflation, the direction of mortgage interest rates remains uncertain. The bond market responded positively to the inflation news, but opinions vary on whether the Bank of Canada will cut interest rates around June or July. Recent economic indicators, such as the producer’s price index, suggest potential for higher inflation in the future. Monitoring economic data will provide clarity on future interest rate decisions by the Bank of Canada.

Inflation for the month of February came in at 2.8%.

That is a drop from the previous month and totally blew the 3.1% expected read out of the water in a good way. Furthermore, all the core inflation reads also dropped from January to February. It’s a really nice trend that’s starting to develop here, which shows that the high interest rate policy of the Bank of Canada is starting to have its desired effect to tame inflation.

Statistics Canada reported that food price deceleration was one of the major contributors to having inflation come in lower, but on the flip side, the contributors to keeping inflation high were gasoline prices and shelter costs. And I’ve said it before on this channel that shelter costs, there’s a real irony there because it is the policy of the Bank of Canada that keeps the shelter costs and interest rates high.

So with this better than expected inflation read, what does that mean for mortgage interest rates in Canada? Well, we can see that the bond market really liked it this morning, minutes after the press release, we saw a nine basis point drop to the five year bond yield.

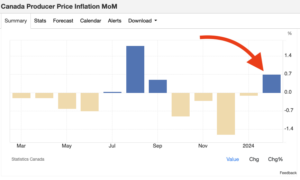

For the past few months, the popular opinion of rate watchers and market participants is that around June, July, the Bank of Canada will start cutting interest rates. However, that is no slam dunk. Just take a look at the recent headlines reported in the media from various economists. There is no clear direction here. Today’s lower than anticipated inflation read is definitely going to be one point for the rate cut in June camp. But it’s really no guarantee. All we have to do is look at the producer’s price index for the month of February, which came in way, way higher than anticipated, and that’s going to work its way through the system and could potentially result in higher inflation reads in the months to come.

Going forward, we’re just going to have to continue to watch the data to get clear indication of when the Bank of Canada is going to cut interest rates. And you can be sure that on this channel, I will be tracking it like a hawk. So like subscribe so you don’t miss an update.