On April 19th 2010 new mortgage rules came into effect which have made it a little bit more challenging to qualify for a variable rate mortgage. Traditionally lenders qualified your maximum mortgage amount based on their current 3 year fixed rate. However, today it is a little bit more complicated and this post will help you if you are considering financing with a variable rate mortgage.

The rate used to qualify your maximum mortgage amount now depends on whether your mortgage is high ratio or not. Generally speaking if the mortgage you require represents 80% (i.e. less than 20% down payment) or more of the value of your home, then your mortgage is high ratio. If your mortgage is high ratio, then the lender is required to use the new Bank of Canada Qualifying rate. This rate is set every Wednesday by the Bank of Canada (Look for series V121764).

If your mortgage represents less than 80% (i.e. more than 20% down payment) of the value of your home then the rate used to qualify is the traditional 3 year fixed rate offered by your lender.

So in practical terms what does this all mean and what is the significance to you?

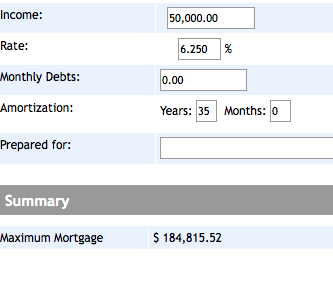

Based on the rates at time of publishing this post the difference is huge. Consider the following scenario for illustration purposes. Assume that your household income is $50,000 per year and you carry no outside debt. If your mortgage is high ratio then the maximum variable rate mortgage you could qualify for would be $184,815 based on the new bank of Canada qualifying rate of 6.25%.

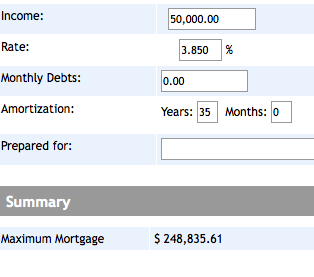

If your mortgage is conventional (or represents less than 80% of the value of your home) then the total mortgage amount you qualify for would be $248,835 based on today’s best 3 year of 3.84%.

That is a difference of $64,000! That means that you may have to sacrifice variable to move into the neighbourhood or home that you want. That means that when you renew your mortgage you may be limited to taking a fixed. That means that you maybe forced to purchase with 20% or more to get the interest rate that you want.