I can’t seem to avoid the conversation about real estate in Canada. This past weekend I must have been asked at least half a dozen times about my thoughts on the market. I always give the same cautiously optimistic response. However I am not an economist and can’t delve deep into the fundamentals but Benjamin Tal, chief economist of CIBC, can.

Here is Mr. Tal’s Fall 2012 Economic Buzz report that he shares with The Mortgage Centre brokers quarterly.

Benjamin Tal Economic Buzz: Should We Worry About a US-Style Housing Meltdown?

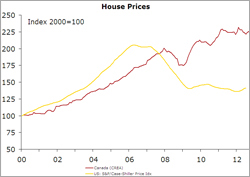

House prices in Canada will probably fall in the coming year or two, but any comparison to the American market of 2006 reflects a deep misunderstanding of the credit landscapes of the pre-crash environment in the US and today’s Canadian market.

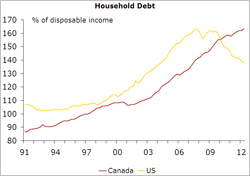

The Canadian housing market has more distinguishing attributes that separate it from the pre-crash US market. Yes, the debt-to-income ratio in Canada just broke the American record set in 2006, but comparing the three years heading into the US crash to the past three years in Canada reveals that the debt-to-income ratio in Canada has been rising at half the speed seen in the pre-crash US market.

The Canadian housing market has more distinguishing attributes that separate it from the pre-crash US market. Yes, the debt-to-income ratio in Canada just broke the American record set in 2006, but comparing the three years heading into the US crash to the past three years in Canada reveals that the debt-to-income ratio in Canada has been rising at half the speed seen in the pre-crash US market.

Even more important than the amount of debt is its quality. The distribution of the credit score in Canada has not changed dramatically in the past four years. That is very different than the experience seen in the US in the four years heading into the recession.

In the US an astonishing one-third of mortgages taken out in 2005 and

In the US an astonishing one-third of mortgages taken out in 2005 and

2006 were in negative equity position, and more than half had less than

5% equity. In Canada, the negative equity position is nil, and only 15-20% of new originations have an equity position of less than 15%.

In a final analysis, not all is well in the Canadian housing market. Home prices are overshooting their fundamentals, mainly in large cities such as Toronto and Vancouver. The recent slowing in sales activity will probably be followed by price adjustments in many cities across the country. But the Canada of today is very different than a pre-recession US. Therefore, when it comes to jitters regarding a US-type meltdown here at home, the only thing we have to fear is fear itself.

November 12, 2012