This week there are two headlines grabbing the attention of mortgage brokers, bankers and borrowers in Canada. Both have far reaching implications in the mortgage industry and it may not be a fluke that both are making headlines in Canada at the same time. On the one side we have the government of Canada expressing concerns about debt levels and the ease for borrowers to attain credit. The other news maker this week is an announcement by mortgage insurer CMHC, a Canadian crown corporation, that they are reaching their insurance limit of $600 Billion as set by the Canadian government. The resulting effect of this news is that insured mortgages in Canada could be harder to qualify for if we see credit lending rules change.

As a consumer it may be very confusing to understand what the concerns and implications are. In this post I’ll address Ottawa’s concern for tightened mortgage rules.

As Canadians we are proud of hockey, our multiculturalism, Celine Dion and our remarkable resilience in the face of global economic decline. Okay, maybe we aren’t so proud of Celine but it’s true, if you have an opportunity to travel abroad and talk business with anyone from outside of Canada there is a tremendous amount of reverence from all corners of the globe for our economic policy and strength. And that is due in large part to our prudent banking system. So if we have such a prudent banking system what is all this fuss about tightened mortgage rules and tightened credit?

Ottawa is becoming more and more uncomfortable with debt levels. Record-low mortgage rates being offered by Canadian banks and the ease with which some institutions are advancing lines of credit seems to be keeping finance minister Jim Flaherty up at night (by the way, the fact the Government is concerned about low rates is a clear indication of where they believe rates are going to be for the short to medium term).

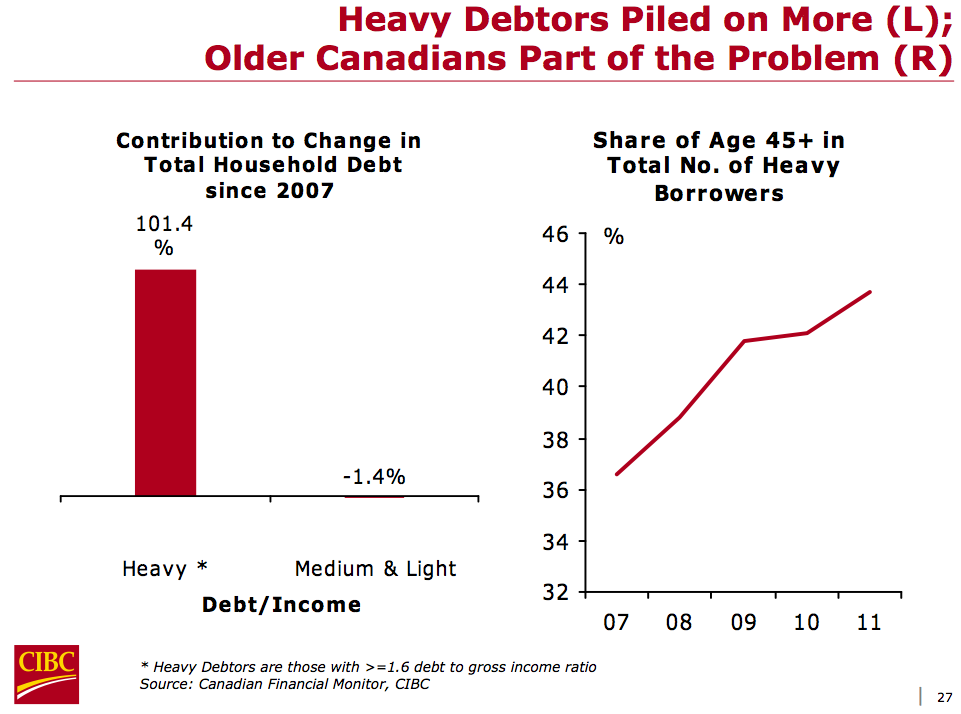

So are Canadians really in that much more debt? The following graph sourced from a presentation by CIBC chief economist, Avery Shenfeld, show some interesting and revealing information about Canadians and their debt. The graph shows that since 2007 borrowers who are considered heavy debtors (see * definition) have piled 101.4% more debt over the last 5 years. Translation: if you owed $10,000 in 2007 you now owe $20,140. While borrowers who are considered light to medium debtors have actually lowered their dependence on credit. Perhaps the more troubling statistic is that of those people who are heavy debtors 44% are 45+. These are the wrong kind of debtors, if the majority were in their 20s and 30s this wouldn’t be so bad as they are leveraging to start out their lives but its never good to have an aging population in debt.

And yet despite the increased number of Canadians who shouldn’t be in debt, I’m not convinced tightened rules is a good idea. It’s one thing for politicians to sit in Ottawa and make statements about credit but the reality on the street is that it has never been harder to qualify for a mortgage. I’m working with mortgage lenders and insurers every day and I can assure you that nothing and I mean nothing gets by them. The number of mortgages that went into default in Canada last year were only 0.38%. Borrowers are required to dot every “i” and cross every “t” and credit is not easily given out like these reports would have you believe. In my experience credit needs to be earned these days.

The conspiracy theorist inside of me (or at least the political one) sees this as a political play to justify the tightening of CMHC rules or some other major change in the mortgage industry effecting borrowers and lenders alike. In the face of what might be an already slowing Canadian real estate market I’m worried about what these changes will mean. Stay tuned for my follow up commentary on CMHC reaching its limit and the implications to the mortgage borrower.

Do you have something add? I’d love to hear about your experience qualifying for a mortgage. Do you think it’s as easy as Ottawa would have us believe? You can contact me here or book a call into my calendar below.