Key points from the April 2023 Bank of Canada announcement:

- As was widely anticipated, the Bank of Canada held the overnight lending rate unchanged at 4.50%.

- This is the second consecutive meeting where the Bank of Canada has held the rate, waiting to see the lagging impact of last year’s 4% increase.

- The BoC noted that while inflation is decelerating, they don’t expect to achieve their 2.00% target until late 2024

- The retail prime rate (what you and I pay) will remain unchanged at 6.70%.

- You can find the full press release here.

The Bank of Canada announces no change to the Canadian policy rate.

Today’s announcement to hold the rate unchanged comes as no surprise to the market and meets expectations.

After two months of better than expected inflation readings the BoC is in a good position to sit back and wait for the lagging effects of their 4.00% interest rate increase last year to work its way through the Canadian economy.

It’s worth noting that it’s still early days. When you consider the lagging impact of higher rates, we still don’t know if the BoC has over-tightened.

Read the full press release here.

RATE FORECAST

Now that inflation is retreating the focus is entirely on recession.

It’s not a question of if we will see a recession at this point but rather – when and how severe.

The timing and arrival of the recession will impact variable and fixed rate mortgages differently.

Variable rates

Variable rate mortgages are influenced by the direction of the prime rate as set by the Bank of Canada. So for variable rate mortgage holders the question is when will the BoC pivot?

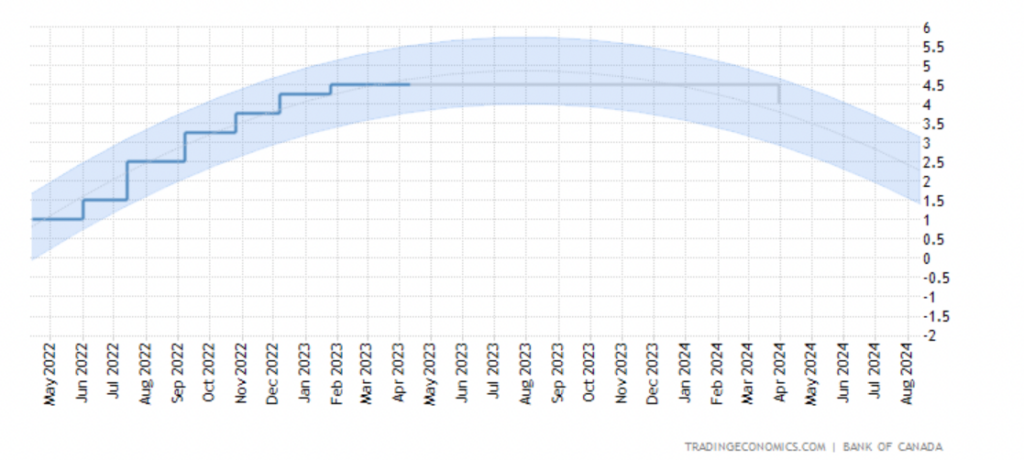

In the chart below you can see that the forecast for rate cuts isn’t expected until early 2024.

However, there are factors that may accelerate that timeline, specifically risks around bank failures which we saw last month and tightening credit conditions for businesses and industry.

Fixed rates

Fixed rates are influenced by bond markets. And bond markets are not currently agreeing with the Bank of Canada’s timeline of events.

Remember, we still don’t know what impact all the rate increases will have on the Canadian economy. Bond traders think that the BoC has overdone it and likely “broken” the economy, which will lead to recession sooner.

There is a strong sentiment that recession is 3 to 6 months away.

We are seeing that reflected in falling fixed rate mortgages, which are currently priced anywhere between 4.50 to 5.00% now, depending on the product and terms.

Should I convert my variable rate mortgage into a fixed?

This becomes an interesting question now worth considering.

With the prime still high at 6.70% and fixed rate mortgage breaking below 5.00% there is a big enough gap to realize sufficient interest savings and payment relief by refinancing.

If you need immediate payment relief it’s worth exploring because there are savings on the table.

However, the decision to convert comes at a cost of future potential savings. We are certain that over the next 12 months rates will continue to drop as we enter a recession. So if you’re in a variable rate mortgage it becomes an exercise in timing the bottom.

If you’d like to discuss today’s decision and how it relates to your mortgage, you can contact me here or schedule a convenient call time directly into my calendar below.