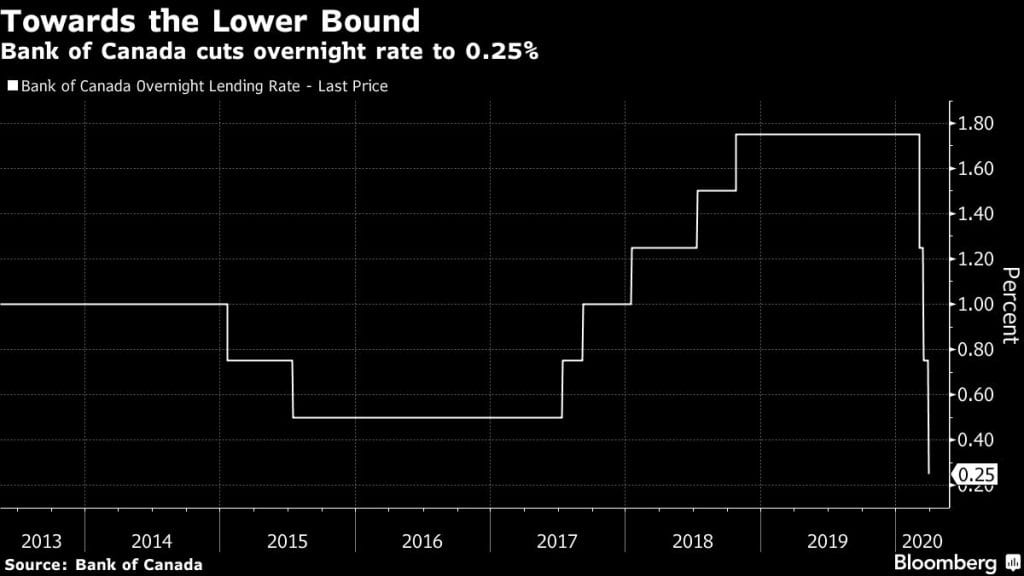

For the 3rd time this month the Bank of Canada cut the overnight lending rate. This is the second emergency rate cut from the bank.

The current policy rate now sits at 0.25% which is a historical low. The bank’s governor, Stephen Poloz, has indicated that this is the lowest the central bank is willing to drop rates and will consider other stimulus in the future.

The decision was made at an emergency meeting by the BoC called to support Canadians and the economy through the fallout of the Corona virus outbreak.

There are 2 critical factors that have driven the emergency decision:

- Approximately 1 million Canadians made unemployment claims and counting. This suggests the economy is poised to suffer one of the sharpest drops in economic activity in history.

- The Canadian economy is also having to cope with the crash in oil prices which is one of the most significant drivers of our economy.

You can read the Bank of Canada’s full press release here.

So what exactly does this decision mean to you and your household?

By 5pm on Friday afternoon the ‘big 5’ banks cut their prime rate to 2.45%.

This means that the rate on your variable rate mortgages, lines of credit and any other loan based on prime will drop by another 50 basis points.

PRO-TIP FROM YOUR BROKER: If you have a variable rate mortgage & you can afford it, now is the time to make head way and payoff your mortgage more quickly. I would recommend taking advantage of your pre-payment options to set your new mortgage payment at the same amount you were paying at the beginning of March. All the extra money will now go to principal repayment vs interest.

Is now a good time to refinance my mortgage?

This is perhaps the most confusing question at the moment. The short and very definite answer is NO.

Even though the prime rate is dropping MORTGAGE INTEREST RATES both fixed and variable have been increasing. This defies conventional logic and market behavior.

The easiest and best explanation as to why mortgage rates aren’t lower is that while the cost of money is cheap the cost for lenders to deliver it to market has gone up. Think of it like oil prices… the global oil price is so low that it costs more to deliver to market than to make it.

As uncertainty eases in the coming months expect rates to come down however for the time being rates are not at place where you want to refinance.

Please contact me directly or schedule an appointment in my calendar if you would like to discuss how recent changes will impact your household.