Bank branches sometimes promote them and you may have come across paper and online ads for them. So what is a cashback mortgage, and more importantly, who should consider them?

A cashback means that the lender will give you 5% of your mortgage amount back as cash. So, if you borrow $100,000 they will also lend you an additional $5,000. The cash can be used for anything however, it is really designed to help buyers who can’t come up with a full 5% down payment, the minimum down payment required to buy a home. If you are buying a home and don’t have the required 5% down payment through a cashback mortgage the lender would provide you with 99.75% of the financing (wondering why 99.75? It’s 5% of 95% financing giving you that 99.75% number). In exchange for the cashback a borrower is expected to pay a higher interest rate. Currently that rate is 4.99% as offered by the National Bank who are running a promotion.

If you’re stretching to buy a home and can’t come up with the required 5% down payment it’s tempting to think that 4.99% isn’t too bad. But once you break down the cashback offer you’ll find that it isn’t that sweet of a deal… at least not for you, the borrower.

Consider the following example (if the numbers below make you dizzy, just skip to the summary section):

Borrower A has her 5% down payment and requires a $250,000 mortgage to buy. Her mortgage is arranged with a fixed 5-year rate of 3.39% amortized over 25 years.

Borrower B couldn’t come up with 5% down payment so he opted to take $250,000 with a 5% cashback. This cashback gave him $12,500. In total borrower B receives $262,500. The cashback mortgage costs borrower B 4.99% for a 5-year term amortized over 25 years. Keep in mind that only $250,000 is registered as a mortgage for a cashback.

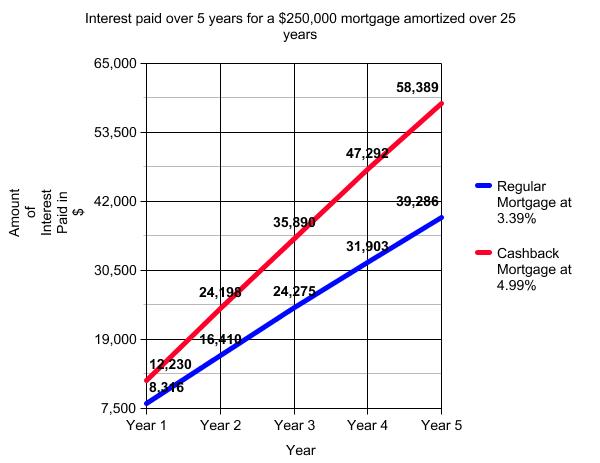

The following graph shows how much interest is paid by Borrower A vs. Borrower B each year given their different interest rates.

The graph shows that by the end of the 5 year mortgage term Borrower B pays $19,103 more in interest to the lender. Of course out of that $19,103 Borrower B is getting the benefit of $12,500 therefore, the cost is $6,603 ($19,103-$12,500). So the actual interest paid on a 5% cashback of $12,500 is close to 10.6% (($6,603/$12,500)/5 years).

The graph shows that by the end of the 5 year mortgage term Borrower B pays $19,103 more in interest to the lender. Of course out of that $19,103 Borrower B is getting the benefit of $12,500 therefore, the cost is $6,603 ($19,103-$12,500). So the actual interest paid on a 5% cashback of $12,500 is close to 10.6% (($6,603/$12,500)/5 years).

It’s also important to note that after 5 years Borrower A‘s outstanding mortgage balance is $215,264 mean while Borrower B‘s outstanding balance is $221,233 (note: all figures are approximate).

The skinny

- The cashback in a 5% cashback mortgage costing approximately 10.6% per year to borrow over a 5 year period

- When a cashback mortgage comes up for renewal 5 years into the mortgage the outstanding balance is significantly higher

- If a borrower breaks their cashback mortgage during the 5 year term there is a clawback on the cash

- Over the entire life of the a cashback mortgage a borrower will pay more interest to the lender

For some first time home buyers the allure of stepping into your first home without needing a significant down payment can be very tempting. There maybe extreme circumstances where the 5% cashback mortgage should be considered to purchase but I wouldn’t advise anyone to step into a cashback mortgage. The premium for the extra funds is too high and if you can’t afford to save the 5% down payment then you are likely not financially ready to own a home.

If you have any further questions about cashback mortgages or any other mortgage product, contact me here or book a call into my calendar below.