When OSFI announced the most recent tweak to mortgage rules, known as the B-20 mortgage rules, there was serious concern about the impact it would have on the market.

The rules, which came into effect on November 1 2017, were far sweeping.

There was outcry from all stakeholders…

Present and would-be home owners were frenzied to position themselves. It was already hard enough to make a purchase in markets like GTA and Vancouver. Adding to the pressure was an estimated 20% drop in mortgage financing capacity.

Mortgage brokers, realtors, home builders all have been lobbying the government for months to ask the governing bodies to relax the rules.

But how bad was it?

Now with the benefit of time and data we can finally start to answer the question about the impact the B-20 mortgage rule changes had and the effects on the market.

The sky didn’t fall

The impact of B-20 is real and yet here we are ~18 months later.

Amid very positive signs that confidence is returning to the GTA market I wanted to share some hard numbers and facts from a TD Economics report entitled- Assess the Stress: Examining the Impact of the B-20 Rules on Housing

Apparently Canadian real estate really is like a balloon

In business, the balloon theory says that when you make changes in one area it often leads to unforeseen and adverse effects in other areas.

Mission accomplished

From a policy objective, the B-20 introduction was a success. Policy makers achieved their goal of slowing down housing activity, improve mortgage quality, slow credit transaction and stabilize household leveraging.

Feelin’ the squeeze

However, policy makers didn’t get it all right.

There were some surprising and unintended consequences which include prolonged, longer than expected sales weakness, increased tightness in rental markets and the migration of borrowers to riskier alternative lenders.

The impact on first time home buyers was also notable with many staying away due to affordability issues.

Below, I’ve highlighted some metrics from the report that you might find interesting.

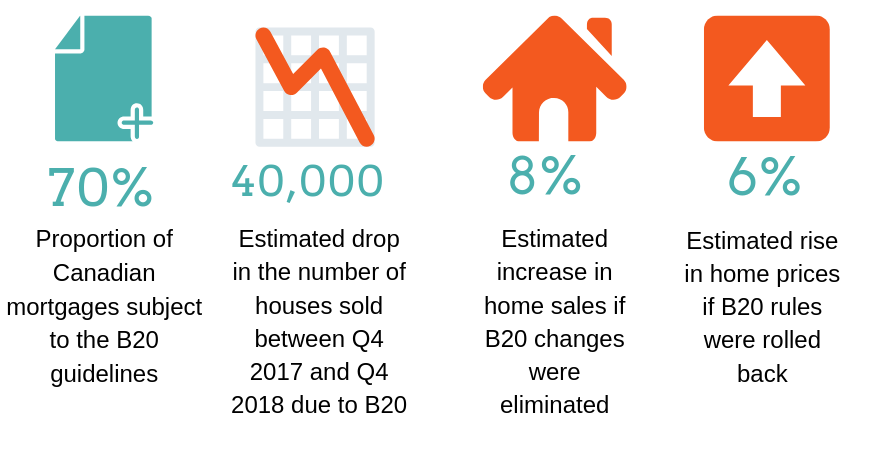

By the numbers… the impact of B-20 mortgage rule changes

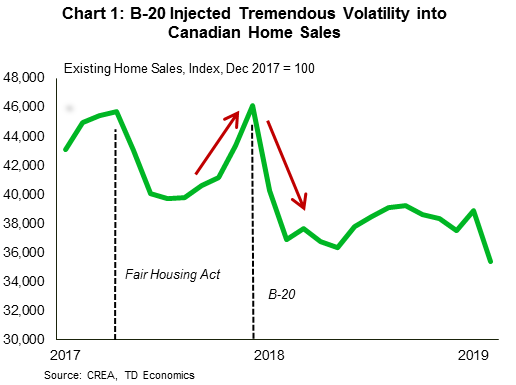

If policy makers wanted to slow down the market they get an A+

The above graph shows monthly sales volume across Canada. Leading up to the B-20 implementation date we see a surge in sales to beat the deadline and then a sharp 20% drop in first quarter after implementation.

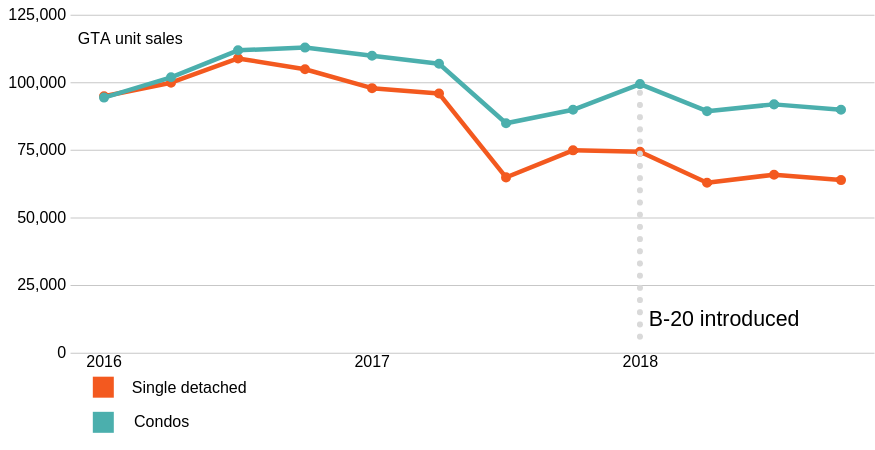

Thinking smaller

Since purchasing power for households across the entire market dropped by about 20% we see a move towards lower priced housing such as condos. The above graph shows GTA condo sales fairing better and being less volatile compared to single detached homes.

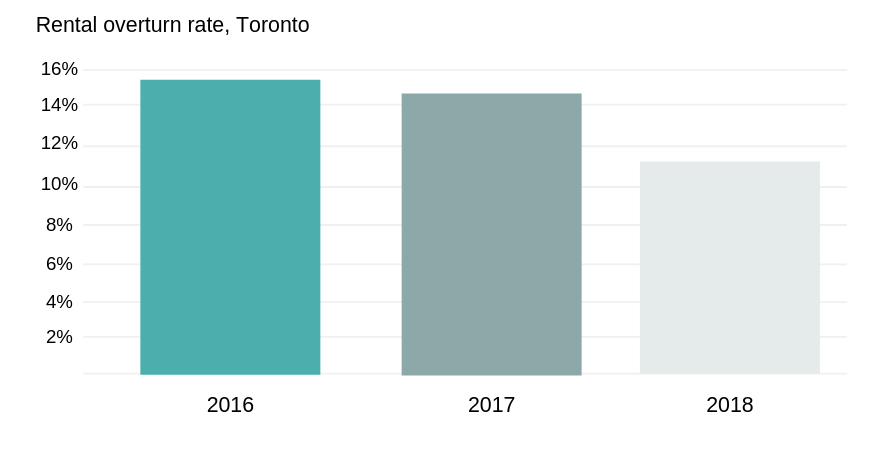

Renters feelin’ the effects

By making homeownership more difficult, the new rules have pushed some would-be buyers to the rental market or forced those that are currently renting to stay put. The graph above shows that renters are not vacating as frequently opting to stay longer. This puts a squeeze on vacancy and in turn drives up rents.

Need to get in touch? Contact me here or book a call into my calendar below.