Variable rate mortgages have historically been the better mortgage option for borrowers in Canada over the past 50 years and yet a little more than a quarter of mortgage borrowers in Canada choose a variable rate mortgage over a fixed rate mortgage. Why is that?

Perhaps the biggest reason has to do with the inherent risks that come with taking a variable rate mortgage. While they can be a great mortgage option it comes with a lot of uncertainty that most borrowers shy away from.

If you are considering a variable rate mortgage for yourself there are 4 key features that you need to understand before deciding if it’s right for you.

1. The Interest Rate You Pay Is Based On A Formula – When you are quoted a variable interest rate it will be based on a formula. The formula is prime plus or minus a certain percentage. For example, consider that you are quoted P-.25% and the prime rate is currently 3.00% then your interest rate is 2.75%.

3.00% – 0.25% = 2.75%

When you are shopping for a variable rate mortgage you are looking for the deepest discount from prime so P-.80% is better than P-.25%. The formula doesn’t change during the term of your mortgage.

2. The Prime Rate Can Fluctuate – What makes a variable rate mortgage vary is the fact that it is based on the prime rate. The prime rate is a rate that is established by the Bank of Canada. The Bank of Canada meets 8 times each calendar year to make policy decisions including what to do about the prime rate. Click here for the schedule of key interest rate announcements.

The prime rate is an important monetary tool used by the Bank to curb inflation or encourage spending and growth in the economy. In a nutshell, when economic times are tough the bank keeps the prime rate low to encourage borrowing and spending in the economy. When the economy is running at full capacity the Bank of Canada will increase the prime rate to slow down borrowing and spending.

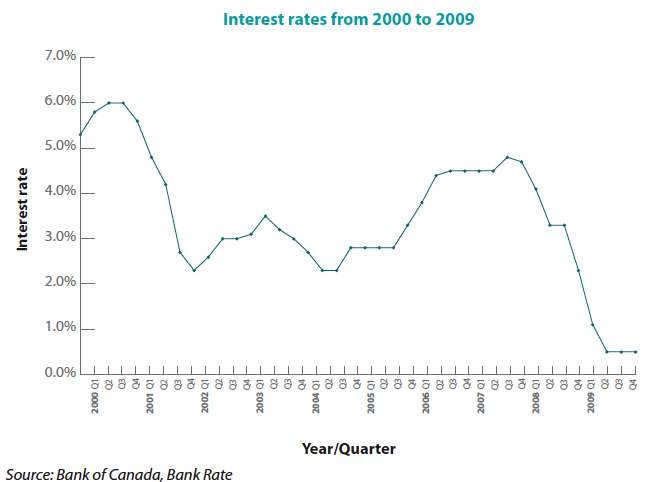

3. Changes To The Prime Rate Mean Changes To Your Mortgage Payment- As the prime rate fluctuates up or down in your variable rate mortgage so do your monthly payments. Since 2009 the prime rate has fluctuated widely between 6.00% down to only 0.50% at its lowest point. It is very important to understand this and be prepared for the eventuality that your mortgage payments may increase during the term of your variable rate mortgage. Here is a graph showing the wild fluctuations of the prime rate from 2000 to 2009.

4. Conversion– A really important feature about variable rate mortgages is the conversion feature. Conversion means that at any point during the term of your variable rate mortgage you can actually convert into a fixed rate mortgage. This is especially important when we are in an upwards rate market where the prime rate may increase over the long term and you’d like to lock in a fixed rate. Note the fixed rate offered to you will be the then current rate you won’t have the option of selecting the same rates available when you originally arranged your variable rate mortgage.

Armed with these 4 points you now know the most defining features about variable rate mortgages.

To decide if a variable rate mortgage is right for you you need to be comfortable with increases to your monthly payment, you should have some awareness of the economy and assess the wider economic conditions to determine if rates are more likely to rise or drop during the term of your mortgage.

To decide if a variable rate mortgage is right for you you need to be comfortable with increases to your monthly payment, you should have some awareness of the economy and assess the wider economic conditions to determine if rates are more likely to rise or drop during the term of your mortgage.

For the latest variable rates visit my rate page or contact me directly here. I can help you decide if a variable rate mortgage is the right choice for you and whether now is the time to consider a variable rate mortgage.

You can also book a call into my calendar below.